Working with you

Credit management for multinational businesses

We know from experience that working with our customers as one team leads to the best outcomes for everyone. It seems obvious, but mutual understanding leads to well-informed decisions - and well-informed decisions lead to successful trading outcomes.

We’re dedicated to supporting multinationals. We’ve been doing it for over 25 years, learning what truly works through our close working partnerships with customers, and fine-tuning our offering to develop the best possible support. That includes:

- Specialised expertise in structuring global trade credit insurance programmes of all shapes and sizes so it’s simple, streamlined and highly effective for you.

- Tailor-made service models driven by your needs - not ours.

- Deep geopolitical and sector-specific knowledge and understanding.

- A fully joined-up approach – our single P+L means we work as one team, globally.

- A dedicated team that includes analysts and key account underwriters, so we get to know you inside out.

The Atradius Global team was set up more than 25 years ago to focus exclusively on the needs of multinational businesses. Today, we’re located in every continent, ready to support you, right where you need us.

Some of the benefits you’ll enjoy as a customer include:

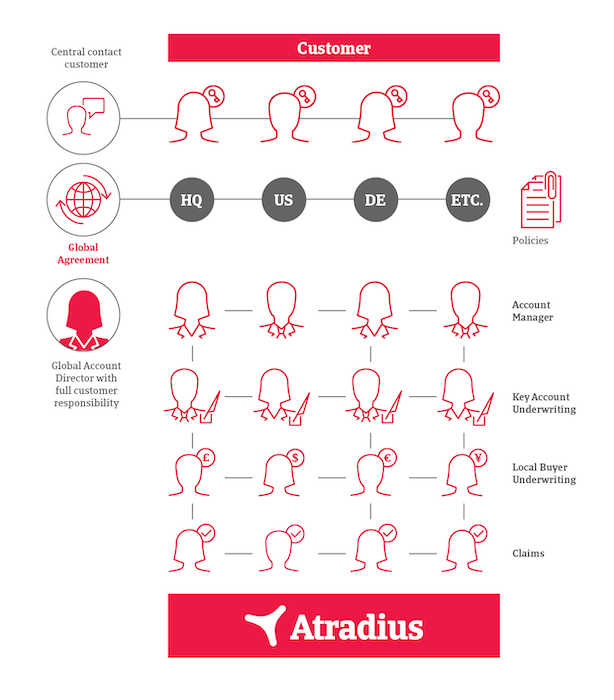

- Your own central Account Manager, who’ll provide face-to-face contact and ensure alignment of terms and cover for you across your portfolio, as well as a network of Account Managers to provide local service and in-depth knowledge to your colleagues around the world.

- Support from specialist analysts and underwriters who provide valuable intelligence on markets, risk, trade and opportunities.

- Our ‘personally global’ service. Our team will mirror yours: local to you, supporting you on the ground, wherever your customers are.

We know that every customer faces a unique set of challenges, and our service is tailored to meet them. At all times our aim is to support, simplify and streamline your risk management so that you can focus on running a successful business knowing you have our full support.

An example of the people here to support you.

Kathryn Dobbs

I’m your main point of contact, making sure you receive a seamless service from us, right round the world. I have extensive experience with multinational customers and I’ll support you every step of the way. I act as a co-ordinator on your behalf to ensure that our team understand your evolving business challenges around the world, so they can give you all the support you need to help your business thrive.

Helena Sothmann

I’m the link between you and our local underwriting teams, ensuring the highest possible cover and consistency across your portfolio. I’ll be delivering the best possible service and cover through a detailed knowledge of your internal processes and policy conditions (AFL, DCL etc.), as well as your key customers, key customers countries and your trade sector.

This detailed knowledge of your business means I’ll keep our risk appetite on your portfolio as high as it can be, especially for your key buyers – I’ll have authority to overrule decisions made by local buyer underwriters and a second view on zero and partial decisions, taking into account the knowledge of your credit management and your relationship with your customers. I’m your point of reference on all credit limit issues and I’m always happy to discuss rationale for decisions if you’d like to, too.

Thomas Rombach

I’m the guy on the ground and in the details. I’m based in the country or region where your customers are, with extensive knowledge of the local economic environment and local business culture. I have an in-depth knowledge of your customers, and as a sector specialist, I’m uniquely qualified to provide the credit limit decisions on your customers.

My promise: I’ll always put myself in your shoes when processing credit limit applications.

Dheeraj Chandra

I’m here to make your claims fast and efficient. I make sure it’s easy for you to submit a claim – and to guide you through the whole process, right up to settlement. I understand how vital it is to know what’s going on – and to get paid. I work alongside your Account Manager so we’re all in the loop and I liaise with our Collections colleagues. Our claims acceptance rate is over 90% and we pay all claims within 30 days - we aim to get your money to you as fast as possible.

Wessam Kamel

I’m experienced in local collections procedures and legal processes, so I help collect outstanding debts, maintain good customer relations and avoid any unnecessary legal recovery costs. I speak the local language and understand the cultural behaviour of the area. I’ll be in continual contact with your debtors, using skip tracing skills for a fast recovery and keeping you in the loop along the way.

Real people and 24-hour tech: we're always on

We all know trade is happening somewhere, 24/7. While we take huge pride in the highly personal service we offer, it’s important you can access what you need at any time. We’ve got it covered.

Atrium is our digital policy management tool, developed in collaboration with our customers. It’s a 24-hour way to stay on top of everything connected to your policy, offering a full, real-time overview of your portfolio, with quick response times and complete transparency across all your policy activities.

Insights offers portfolio analysis online, so you can identify risks, monitor portfolio performance and find new business opportunities. It’s won awards across the industry – you may like to try it and find out why.

Our aim is that our service is always streamlined and simple for you, so you get exactly what you need, fast and effectively.

Testimonials

Hitachi Europe Ltd

Multi-sector

Credit insurance is an important business tool for us. Without credit insurance it would be more difficult to expand in markets where we have less knowledge or experience. The business intelligence that Atradius shares with us helps us manage our credit processes and ongoing relationships with our insured customers.

Essam Malash

European Credit Risk Manager