Our case studies provide examples of high quality credit management processes and practices in a variety of different sectors and markets throughout the world.

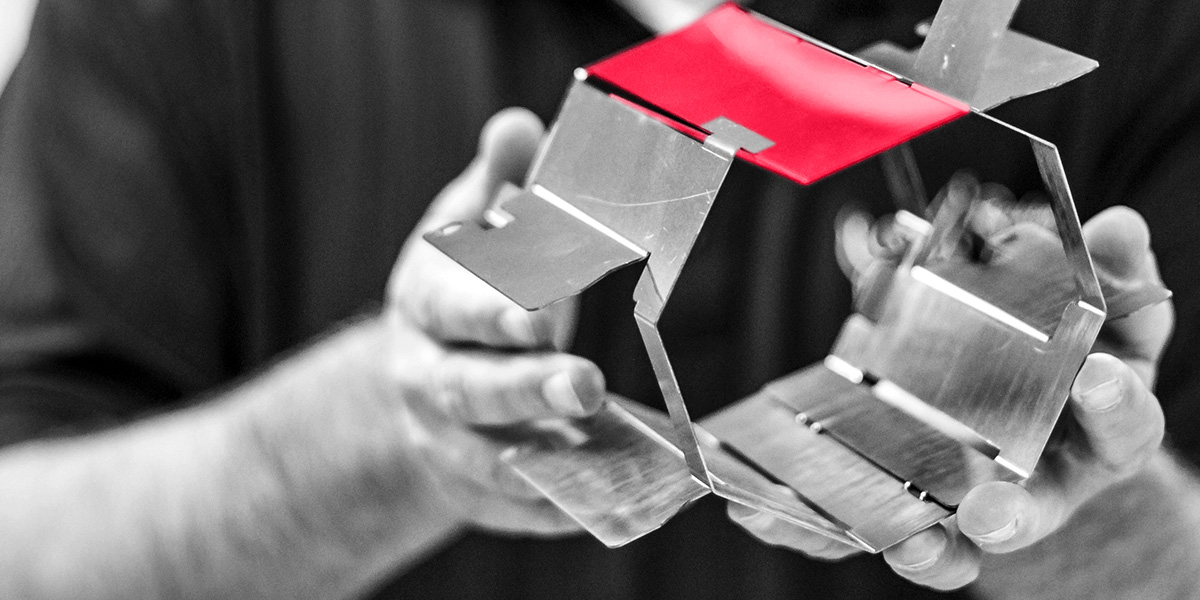

Metalco

Metalco was founded over 20 years ago to distribute high-quality metals to customers across the United States. Since then, its inventory has expanded to include domestic and imported metals produced around the world. When Metalco needed a credit insurer to become proactive in the steel sector, Atradius committed.

_______________________________________________

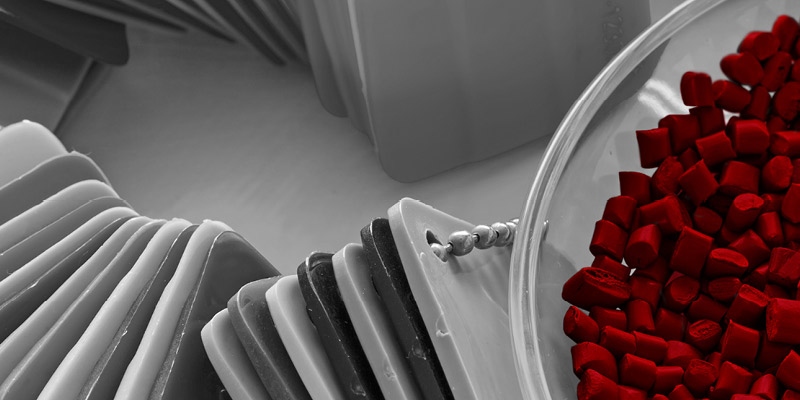

EnCom Polymers

When EnCom Polymers suffered a revenue loss due to customer credit issues in 2019, the company knew it was time to invest in trade credit insurance. EnCom Polymers selected Atradius to help mitigate customer credit risk, expand sales and improve its credit management processes.

_______________________________________________

Legrand AV

Legrand AV Brands has been in business in the U.S. for 25 years, providing power, light and data to millions of spaces around the world in the form of AV equipment and devices. Legrand AV is no stranger to trade credit insurance. The company made the switch to Atradius, however, after finding its previous insurer expensive, inefficient and overly complicated to work with.

_______________________________________________

Bochumer Verein Verkehrstechnik (BVV)

Traditional and modern technology – only a few companies can combine these as effectively as Bochumer Verein Verkehrstechnik, BVV for short. The company has been manufacturing cast steel products in Bochum since 1842, making it one of the pioneers of steel processing. It started out by casting bells, followed a short time later shortly after by seamless wheel tyres for the emerging railway industry.

_______________________________________________

Veka AG

Anybody building a house or renovating an apartment is sure to come across VEKA’s door and window profiles. What began in 1969 as a small manufacturer of roller shutters has now become the world’s leading producer of plastic profile systems with a global workforce of more than 6,000 and annual revenues of more than 1 billion EUR.

_______________________________________________

Henrich Baustoffzentrum, Germany

Germany’s building industry is booming. At the same time, the sector is still giving credit managers sleepless nights. The reason: although their order books are full, a large number of construction companies are exposed to above-average risks of payment default. Henrich Baustoffzentrum has been an active stakeholder in this challenging market for more than 150 years. One of its success factors: continuous work on its own credit management. Here the family-run company describes how it relies on us to cover its receivables.

_______________________________________________

Rashi Peripherals, India

Rashi Peripherals is one of India’s leading IT distributors with a track record spanning nearly 30 years. Navin Agarwal, Head of Accounts and Finance at Rashi Peripherals describes our work as an integral part of their own credit control processes.

_______________________________________________

Henkell & Co.-Gruppe, Germany

When it comes to seasonal demand, the Sparkling wine industry is a classic example of the challenges these spikes in demand bring and the need to have good credit management processes in place. Atradius has been supporting Henkell for over 20 years, providing cover quickly at peak times, and thereby helping them to trade successfully worldwide.

_______________________________________________

Vinci Construction France

Atradius Bonding has enabled Vinci Construction France to expand their sources of finance beyond their banking partners. This partnership with Atradius benefits Vinci Construction by providing substantial flexibility, excellent responsiveness and a capacity for innovation.

_______________________________________________

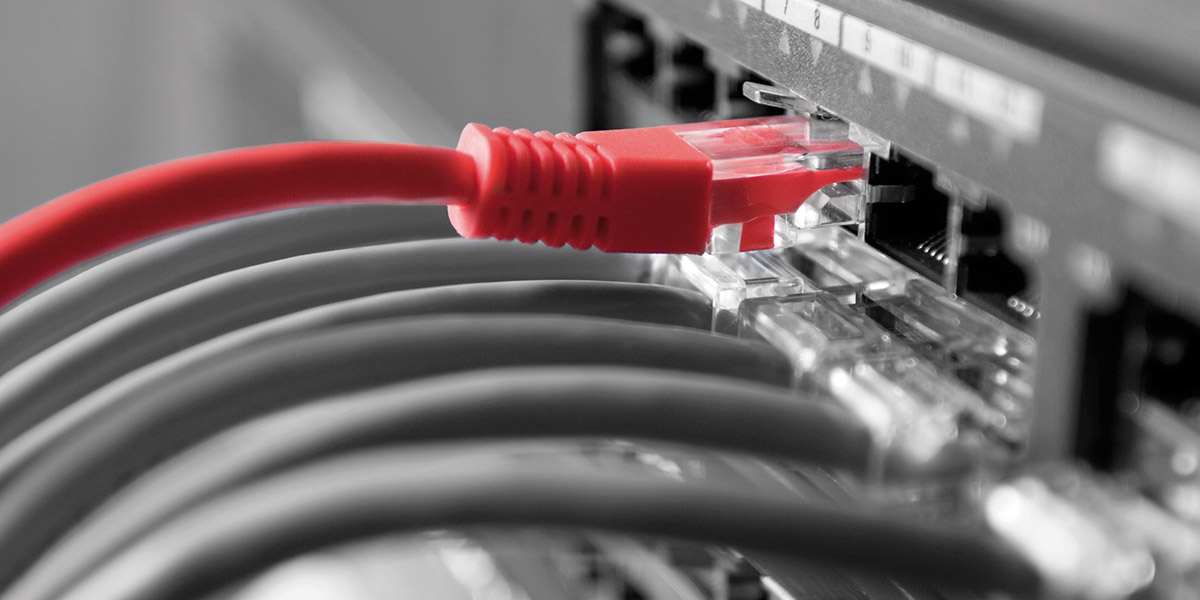

Colt Technology Services

ICT company, Colt Technology Services, use Atradius Collections for amicable and swift resolutions to unpaid bills. This enables them to focus on their customer-oriented practice and their business priorities, which include commercial and financial growth, as well as sustainability and charity work.

_______________________________________________

Continental Banden Groep B.V.

Automotive parts company, Continental, enjoys peace of mind and a dynamic approach to informed sales procedures with credit insurance across their entire receivables portfolio. Their credit insurance team works closely with their sales teams to design contracts tailored to the needs of individual buyers.

_______________________________________________

Elders

With hundreds of outlets throughout Australia and a significant export business, credit management is a key part of Elders’ overall business strategy. Credit Insurance forms part of their agribusiness policy, where Elders aim to add an extra layer of comfort as part of a wider and detailed risk mitigation strategy.

_______________________________________________

Follett

The ice machine manufacturer, Follett Corporation, uses Atradius Credit Insurance alongside market intelligence to support their central operational priority of risk mitigation. This insight enables the company to confidently offer appropriate credit terms and has helped Follett grow substantially in a short period of time.

_______________________________________________

Ingram Micro

A key objective of multinational technology company, Ingram Micro, is achieving ‘business balance’ with sales on one side and risk on the other. Outsourcing credit management to us enabled the company to better understand and take a more balanced approach to risk.

_______________________________________________

Klaus Faber AG

The operational strategy of wholesale supplier of wires and cables, Klaus Faber, is to minimise risk, and maintain a sustainable balance sheet regardless of the economic climate. Credit insurance plays an important role in the strategic development of their business, in particular with regard to loss prevention and debt default.

_______________________________________________

L’Oréal

As a successful beauty products business, L’Oréal Hong Kong partner with to help protect their regional interests and support their focus on further growth. In addition to insuring their existing business, we provide L’Oréal Hong Kong with the knowledge and confidence to develop their business and gain new customers.

_______________________________________________

Norebo

Atradius Credit Insurance is used to support Norebo's (formerly Ocean Trawlers’) sales strategy, which has been very successful in a range of markets over the past few years. The fishing company benefitted from our flexible and prompt approach to increases in credit limits for product testing and market development.

_______________________________________________

Park Polymers

A fast credit decision process for Park Polymers enables the recycling company to quickly determine the credit worthiness of buyers, which enables them to sign on new customers quickly and increase credit lines to established customers, in order to create robust business growth.

_______________________________________________

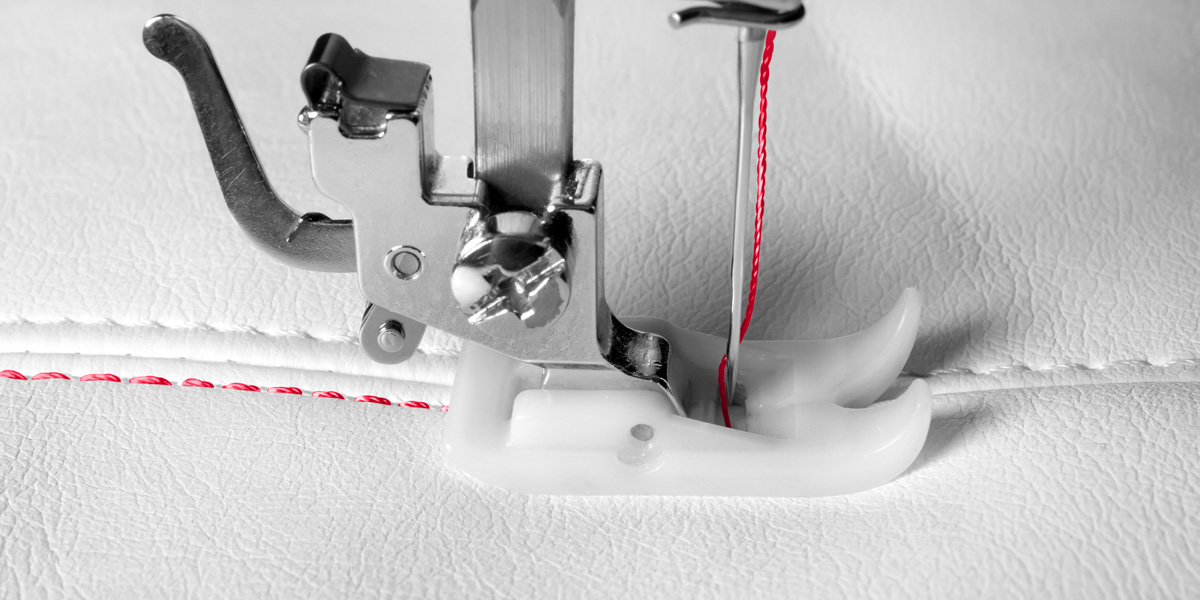

Pittards

A key objective for the premium leather goods company, Pittards, is to continue to build on its successful export model, while developing new markets through new product offerings. With their strong partnership model and our understanding of their business aims, operation and market, Pittards continues to thrive.

_______________________________________________

PORR AG

PORR AG is a dynamic construction and civil engineering company working in several geographies, whose success is built on strong relationships developed with clients, suppliers and staff. PORR uses various guarantee and surety products, each tailored to the construction project’s individual needs and characteristics.

_______________________________________________