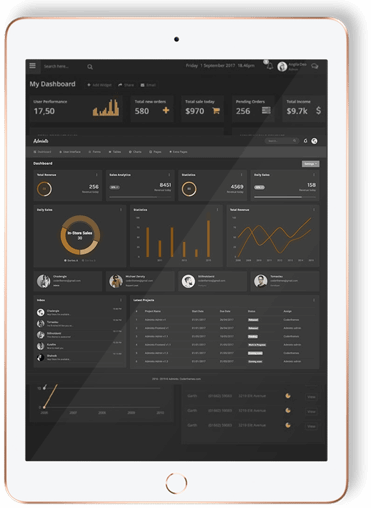

Real-time data exchange

Send applications for cover without leaving your own system, receive decisions and get buyer information directly in your own environment

Fast and accurate

Speed up your credit management processes, reduce the workload managing your policies and be guaranteed there are no manual mistakes.

Dynamic and flexible

Optimise your credit risk management tools and have a holistic overview of your insured portfolio by integrating our data into your system.

High data volume

Sending large volumes of data and receiving information back in real-time directly from and to your system has never been easier.