In the Belgian food retail segment a comprehensive price war cannot be ruled out for the future, potentially forcing many businesses out of the market.

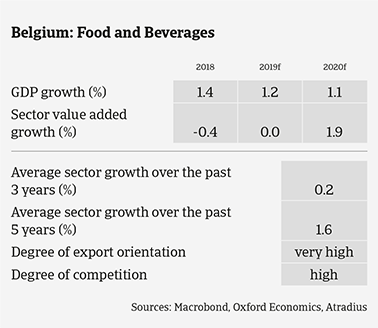

Value added growth in the Belgian food and beverage industry contracted in 2018 and recorded no increase in 2019. Competition in the domestic and international markets is increasing. The entry of new players, a hot summer in 2018 and the African swine fever epidemic have put additional pressure on prices and affected sales in many segments. Profit margins of Belgian food businesses have decreased in 2019, and are expected to deteriorate further in 2020.

In the food retail segment the market entry and expansion of two large Dutch supermarket chains will add more competition with higher pressure on prices, impacting profit margins of Belgian retailers and food producers/processors. A comprehensive price war cannot be ruled out for the future, potentially forcing many bussinesses out of the market.

The value added in the Belgian meat sector is forecast to contract about 1.5% in 2019 and 1% in 2020. Hygiene problems have affected some businesses , while the outbreak of the African swine fever in Belgium has led to decreased sales of pork meat and an import ban from China. In the fish segment fierce competition and liquidity issues have led to many business failures.

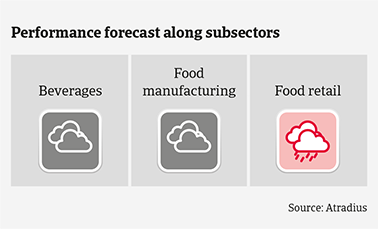

In the Belgian beverages sector competition in the beer segment is further increasing due to the emergence of many new local breweries. However, sales margins are expected to remain stable, while there are more export opportunities for specialty beers.

The fruit subsector continues to suffer from the ongoing Russian import ban on EU food products, putting serious pressure on businesses sales and margins (especially in the apple and pears segment).

Modest value added growth is forecast for the Belgian dairy sector in 2019 (up 0.5%) and in 2020 (up 1.8%). While the situation remains stable for the time being, Belgian businesses highly dependent on exports to the US could be negatively impacted by the recently imposed US tariffs on EU food imports.

Payments in the Belgian food industry take 30 days on average. We expect both payment delays and insolvencies to increase in the coming months, due to increasing pressure on prices and margins along the value chain, coupled with elevated downside risks for food exporters (import bans and tariffs). With a negative outlook on sales and profit margins for many companies, food business failures are expected to increase by about 5% in 2020.

Due to the more subdued business development and credit risk situation we have recently downgraded the Belgian food sector performance assessment from “Good” to “Fair”. Our underwriting stance is more restrictive on the food retail and meat and fish subsectors, and remains neutral for beverages and dairy for the time being.

Related documents

1.19MB PDF