In 2019, another 4% increase is expected in Swiss insolvencies.

Next year, we expect to see some stabilisation of insolvencies at high levels, with a -1% change forecast. Risks – especially external demand and capacity constraints – remain to the downside.

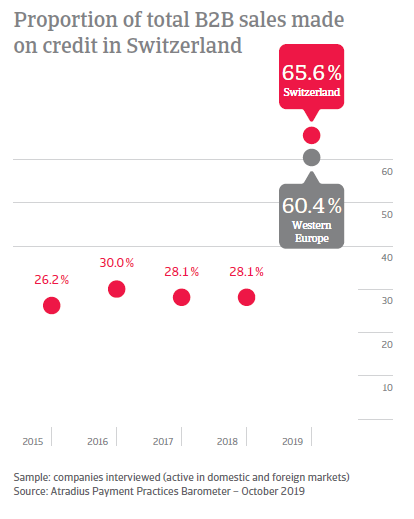

B2B credit-based sales in Switzerland increased significantly over the past year

Respondents to our Payment Practices Barometer Survey in Switzerland reported 65.6% of B2B sales were made on credit in 2019 (a significant increase on last year, which averaged 28.1%). This puts Switzerland first among the countries surveyed in Western Europe, ahead of Austria (65.3%, up from 29.5% last year) and Germany (59.3% up from 24.7% one year ago). In Western Europe overall, credit-based sales increased to 60.4% from 41.4% last year.

The increased use of B2B trade credit might reflect the need of businesses to boost sales on foreign markets, to offset the negative impact the strong Swiss franc has on export flows. Domestically, it may also reflect the current insolvency environment, where further business failures are expected. In this regard, B2B trade credit plays a chiefly financial role, with suppliers providing liquidity to their customers in the form of deferred payment.

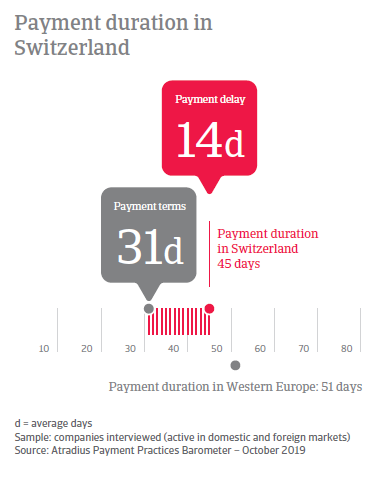

Swiss B2B customers are offered longer credit terms than last year

Compared to the same survey period last year, survey respondents in Switzerland grant longer for the settlement of B2B invoices. Average payment terms recorded in Switzerland stand at 31 days from invoicing (up from 27 days last year). These compare to a 34 days average for the region.

Swiss businesses perform credit checks more often than their peers in Western Europe

The most common credit management technique in Switzerland is the assessment of a customer’s creditworthiness prior to any trade credit decision. More respondents in Switzerland (38%) perform credit checks than in Western Europe (35%). Once an invoice becomes overdue, 37% of the respondents in Switzerland (far more than the 28% in Western Europe) engage in dunning activities (outstanding invoice reminders). Likewise, far more survey respondents in Switzerland (31%), than in Western Europe (24%) reserve against bad debts.

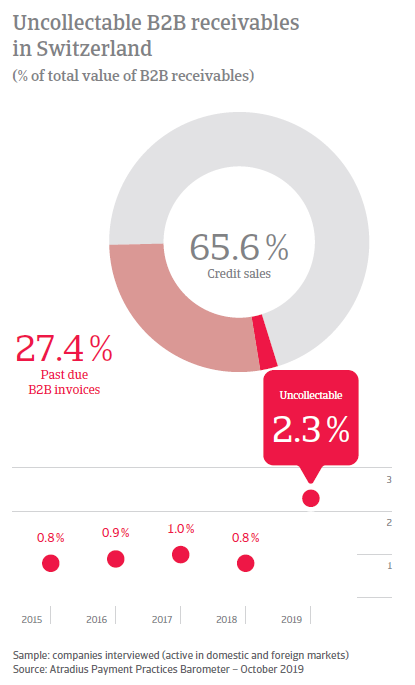

Collection of overdue invoices in Switzerland way less successful than last year

27.4% of the total value of B2B invoices issued by survey respondents in Switzerland over the past year remained outstanding past the due date. This compares to the 28.9% average for Western Europe. Despite increased timely payments from B2B customers (69.2% of invoices paid on time, up from 57.1% one year ago), respondents in Switzerland do not turn overdue invoices into cash earlier than last year (on average within 45 days from invoicing as one year ago). This is in contrast with survey findings at regional level, where average invoice-to-cash turnaround decreased to 51 days down from 57 days last year. More respondents in Switzerland (50%), than in Western Europe (42%), reported no significant impact on business arising from late payments. This suggests Swiss respondents have a sharp focus on the management of receivables. Despite this, survey findings in Switzerland highlight a significant increase in the proportion of write-offs of uncollectable accounts, currently averaging 2.3% of the total value of B2B receivables (up from less than 1% last year). This compares to a 2.2% average for Western Europe. This signals significantly lower efficiency in collection of overdue accounts compared to the same survey period last year.

Far more respondents in Switzerland than in Western Europe pessimistic about B2B trend of customers’ payment practices over the coming months

More Swiss respondents expect B2B payment practices to deteriorate over the coming months (25%) than those expecting an improvement (16%). 59% of Swiss survey respondents believe their B2B customers’ payments will not change significantly over the coming months. 55% of respondents in Western Europe share the same opinion. To protect their business from the risk of payment default, 34% of Swiss survey respondents will either perform customers’ credit quality checks more often, or will increase buyers’ credit risk monitoring. More respondents in Switzerland (28%) than in Western Europe (25%) believe access to bank financing will be tighter over the coming months. Should access to finance become difficult, 37% of respondents in Switzerland (compared to 28% in Western Europe) say they will cut operational costs, while 33% of respondents (30% in Western Europe) will have to reduce the workforce through layoffs or hire freezes.

Overview of payment practices in Switzerland

By business sector

B2B customers in the Swiss agri-food sector are extended the longest payment terms

Survey findings in Switzerland reveal that respondents from the agri-food sector extended the longest payment terms to their B2B customers (averaging 54 days from invoicing). Average payment terms across the other sectors surveyed in Switzerland range from 39 days in the consumer durables sector, to 22 days in the ICT/electronics sector.

Trade credit risk has significantly deteriorated in the Swiss construction sector

Over the past year trade credit risk in the Swiss construction sector has significantly deteriorated to the point where nearly one third of the total value of B2B invoices remained unpaid at the due date. In the construction and agri-food sectors the average invoice to cash turnaround increased significantly over the past year. The Swiss ICT/electronics sector recorded the greatest improvement in customers’ payment speed compared to one year ago. The consumer durables sector recorded the lowest proportion of past due B2B invoices to a low of 18%.

Proportion of receivables written off as uncollectable is highest in construction sector

The Swiss construction sector recorded the highest proportion of B2B receivables written off as uncollectable (2.7% up from 1.2% last year). Across all other sectors surveyed in Switzerland, the proportion of overdue B2B invoices written off as uncollectable ranges from 2.6% in both the ICT/electronics sector, to 2.0% in the machines sector. At the lower end of the scale, the consumer durables sector recorded an average of 1.8% of receivables written off as uncollectable (up from less than 1.1% last year).

By business size

Average payment terms granted to B2B customers from respondents from all business sizes are consistent with the country average

Respondents from micro enterprises in Switzerland extended the longest payment terms to B2B customers, averaging 32 days from invoicing. In contrast, large enterprises offered payment terms to B2B customers averaging 31 days and SMEs 30 days from the invoice date.

Swiss micro enterprises cash in overdue invoices later than one year ago

Swiss micro enterprises cash in past due payments notably later than one year ago (on average with 47 days from invoicing, up from 40 days last year), and 25% of invoices are past due payments. In contrast, the payment behaviour of B2B customers of Swiss large enterprises improved markedly over the past year. The proportion of invoices paid on time increased to 66% from 36% one year ago. Swiss large enterprises also collect payment of past due invoices earlier than last year (on average with 45 days from invoicing down from 51 last year). Similarly, SMEs display a shorter invoice-to-cash turnaround than last year (on average 44 days from invoicing, down from 49 last year). This is likely to have been triggered by an increase in on time payments to 68% of the total value of B2B invoices, up from 53% last year.

Swiss large enterprises recorded the highest rate of receivables written off as uncollectable

With 3.1% of B2B invoices written off as uncollectable (up from less than 1% last year), large enterprises in Switzerland display notably much lower efficiency than last year when it comes to collecting long-term overdue payments. The average for SMEs is 2.5% (up from 1.1% last year) and 1.8 % for micro enterprises (up from less than 1% last year).

Mathias Freudenreich, Country Manager of Atradius Switzerland: “Western Europe faces a 2.7% increase in insolvencies this year as economic growth decelerates and the manufacturing sector struggles amid lower global trade. Switzerland is contributing significantly to the region’s upward trend, as the number of Swiss business insolvencies has been constantly increasing since the aftermath of the eurozone debt crisis.

The increase in insolvencies expected in Switzerland this year marks another year of record-high business failures in the country, and puts a strain on businesses financial stability. Adding to this is the strength of the Swiss currency, which is particularly challenging for the construction sector and Swiss exporters, the latter of which comprises two-thirds of Swiss GDP.

Looking ahead, we forecast some stabilisation of insolvencies at high levels in Switzerland. As our survey shows, businesses are concerned about a deterioration of their B2B payment practices and are working to protect themselves from payment default risks, striving to grow the business despite the number of challenges they face.”