Advanced semiconductors for AI and industrial automation drive world’s fastest growing sector

The global electronics/ICT industry is enjoying a period of healthy growth. In fact the industry is predicted to be one of the world’s fastest growing sectors over the next couple of years. Growth will peak this year and in 2025 and will settle into a pattern of fairly robust growth thereafter.

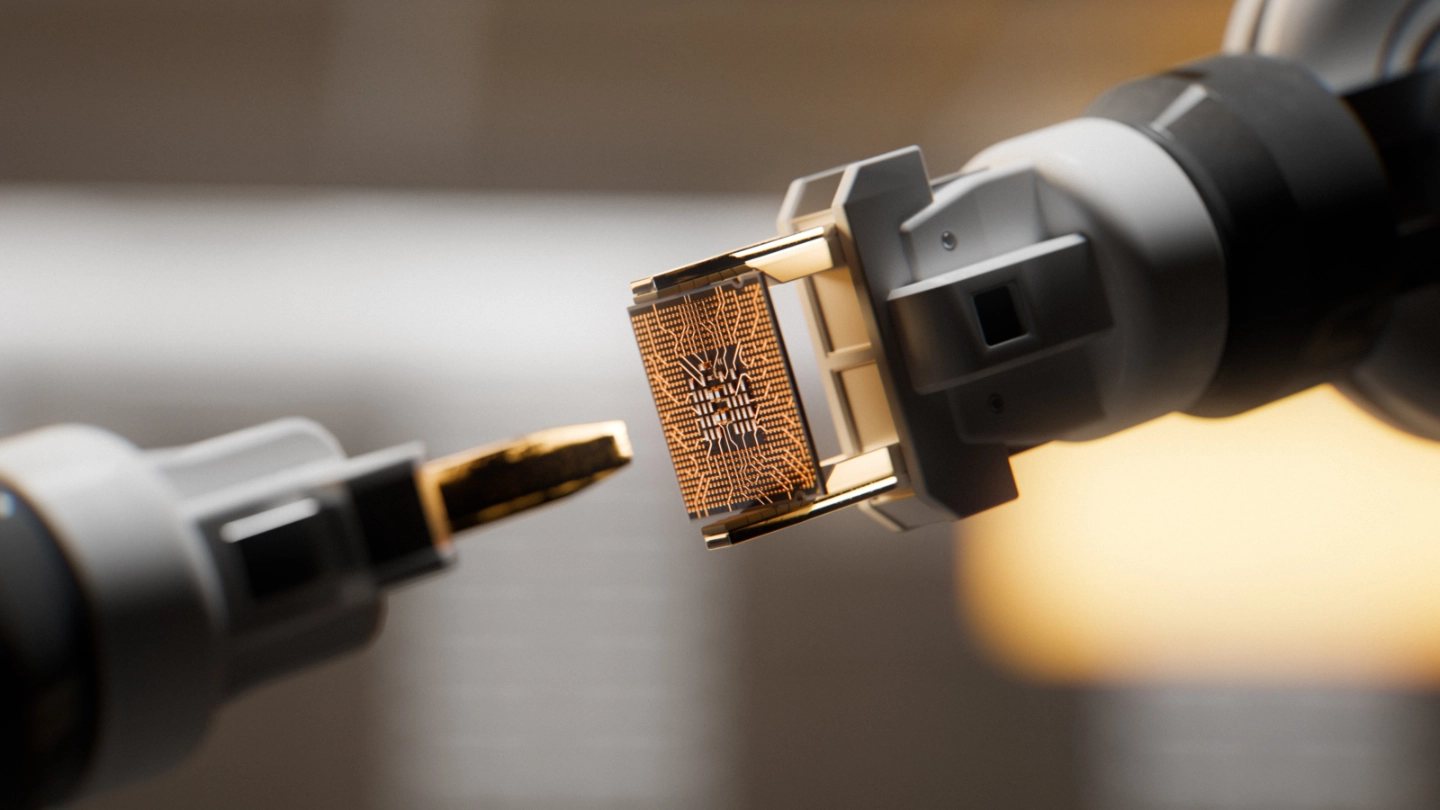

There are several drivers behind the growth forecast but a common factor to all is the computer chip, and in particular, advanced semiconductors. These are in demand from the AI sector where ‘superchips’ are sought after for their ability to meet the needs of technology such as generative AI.

Semiconductors are also a central component required in other growth sectors including electric vehicles, industrial automation and business digitalisation.

Will ICT grow in every region across the world?

On the whole, the forecast growth pattern will be replicated across the world, with the greatest levels predicted for Asia Pacific and the lowest in Europe. That said, even European output growth is good and is anticipated to maintain a healthy 3.5% or so through 2025 and 2026.

While semiconductors are a key part of global growth, the majority of high-end chips are produced in Taiwan, followed by Korea. This situation is likely to remain unchanged, at least in the short term.

How are different regions responding to the growing need for chips?

European and North American markets are responding to the challenge of securing supplies of advanced semiconductors through investment in chip production. The focus here is on re-shoring.

The EU Chips Act is set to invest EUR 43 billion in local semiconductor production and research, with the aim of lowering dependence on imports from Asia and achieving a 20% share of global chip production by 2030.

In the US, the CHIPS and Science Act has provided subsidies and tax credits in a bid to boost local production.

Chip production in Europe and North America is unlikely to catch up with Taiwanese dominance in the short term, however. Whether they can in the longer term remains to be seen, especially as the technology behind advanced semiconductors is evolving so quickly and other risks, such as delays in building production centres and ‘chip nationalism’ could impact productivity and profitability.

How will a Trump White House impact the global industry?

One of the greatest uncertainties is around the policies that the Trump administration will bring in during 2025. If tariffs on Chinese imports are raised to 60%, Chinese businesses would pivot towards their domestic market, but are likely to lose as much as 20% of electronics exports to the US.

The imposition of new or higher US trade tariffs also has the potential to disrupt global supply chains. Much will depend on which of President Trump’s proposals are enacted and how markets respond.

How does growth in related sectors impact electronics/ICT?

A rebound in sectors such as electric vehicles, manufacturing and cloud computing is beneficial to the electronics and ICT industry. I take note of these, and other growth drivers, in my latest Industry Trends overview on the electronics and ICT industry which you can download below.

Download our Industry Trends: Electronics/ICT report