Risk-averse approach amid rise in late payments and bad debts

A risk-averse mood is apparent among companies in our survey of the B2B landscape in Bulgaria. Around 43% of sales to business customers are transacted on credit, an indicator that trade credit remains a key sales tool. Most companies have not altered their credit policies in recent months, choosing instead to maintain stability amid economic uncertainty. Among those who do make changes, more opt to extend credit terms rather than restrict them, highlighting a strategic effort to foster customer relationships and support sales.

Days Sales Outstanding (DSO) is either stable or worse for many, while inventory turnover remains flat or even negative, tying up additional liquidity. In response, Days Payables Outstanding (DPO) has lengthened, with many businesses choosing to delay supplier payments as short-term relief from liquidity pressures. Invoice financing is the most relied-upon external funding option, followed by bank loans and supplier credit. However, invoice financing, while useful for quick liquidity, may carry higher costs.

What are the concerns for Bulgarian businesses in the coming months?

Turbulent trading conditions spark concern about rising risk of insolvencies

Companies across all sectors in Bulgaria are bracing for a more turbulent financial environment in the months ahead amid growing concern about customer liquidity and economic instability, particularly in a market already challenged by prolonged payment cycles and tighter cash flow conditions. This mood of anxiety is highlighted by 71% of businesses telling us they expect an increase in B2B customer insolvencies, a steep rise compared to the same period last year.

As Bulgarian businesses face growing concerns over B2B customers’ financial they strengthen focus on maintaining liquidity, managing payment risk, and staying agile in an increasingly unpredictable economic environment

Increasing regulatory burdens and compliance requirements are major concerns for the future, alongside rising production input costs which are already influencing operational decisions and investment planning. Attracting and retaining skilled talent also remains a pressing issue, particularly in a competitive labour market. In this climate of uncertainty, Bulgarian businesses are prioritizing resilience. While cautious about growth, they are actively seeking ways to protect liquidity, manage credit risk, and adapt to regulatory and economic shifts. The coming months will test their agility and strategic planning as they navigate a challenging business environment.

Industry insights

Agri-food

42% of B2B sales are currently transacted on credit in this sector, suggesting companies keep a careful balance between supporting customer relationships and managing risk. Trade credit offerings are stable for 53% of businesses, and around three in five firms report offering steady payment terms. Most credit periods cap at 60 days, reflecting a measured payment policy. Overdue payments have declined significantly, now affecting an average of 46% of B2B invoices. Liquidity constraints remain a key driver of late payments.

Bad debts have also dropped but still average 8% of invoices, placing strain on cash flow and working capital.

Pharma

Companies in the pharma sector have largely increased trade credit offerings in recent months, with the remainder opting to maintain rather than reduce availability. On average, 42% of B2B sales are now transacted on credit, reflecting a cautious but customer-supportive approach. Payment policies remain mixed. Nearly half of businesses report steady payment terms, while the rest are more likely to extend terms rather than shorten them, most capping at 60 days from invoicing. Overdue payments remain stubbornly high, affecting 63% of B2B invoices. Bad debts have climbed slightly above 10% of B2B invoices, increasing pressure on cash flow.

Steel and metals

Most firms in this sector have increased credit offerings to support customer relationships, while the rest maintained current levels. On average, 44% of B2B sales are now made on credit, a strategic move to drive sales in a price-sensitive market. While many companies held payment terms steady, a significant portion extended them, with most averaging 50 days from invoicing. Overdue payments have risen sharply, now affecting 66% of B2B invoices. Liquidity challenges among customers are the main cause. Bad debts now average more than 10% of invoices, up from last year, amplifying cash flow pressure and draining liquidity.

Interested in finding out more?

For a complete overview of the 2025 survey results for Bulgaria, download the full report available in the related documents section below.

To explore more on how these insights can strengthen your own credit risk strategy, speak with us at Atradius to see how we can help you stay ahead.

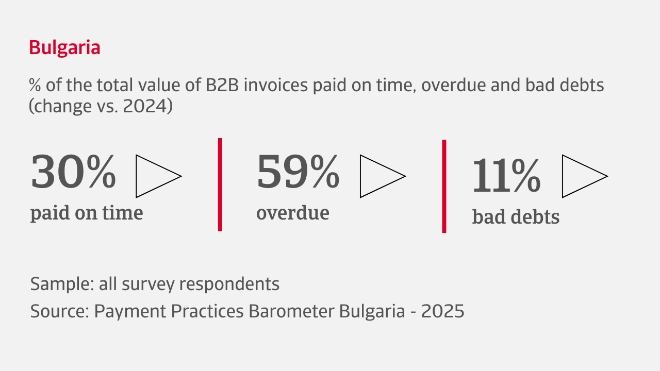

- Nearly 60% of the invoices issued by Bulgarian companies in B2B trade are overdue, causing cash flow issues and marked bad debts levels

- Amid high overdue rates causing liquidity pressures, Bulgarian businesses are focusing on customer payment risk mitigation to maintain stability and financial health

- 71% of businesses expect an increase in B2B customer insolvencies in the coming months

- Growing regulatory burdens and compliance requirements are major concerns for the future, alongside rising production input costs which are already influencing operational decisions and investment planning