What is driving businesses’ increased focus on credit risk management in Ireland?

Liquidity pressures place sharp focus on strategic payment risk management

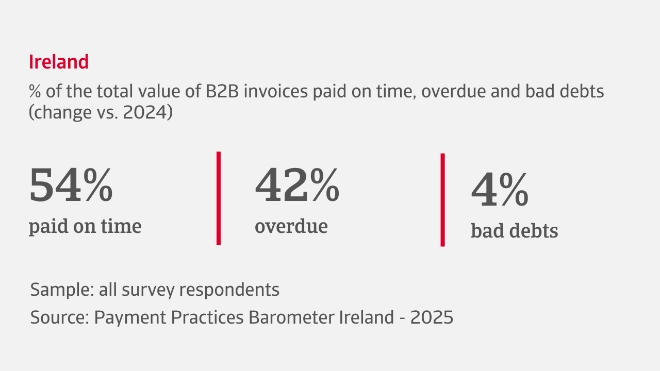

The payment behaviour of business-to-business (B2B) customers across industries in Ireland has remained broadly consistent in recent months, but this apparent stability does not necessarily reflect financial ease.

Trade credit continues to play a key role in B2B transactions, now accounting for 58% of sales to business customers. Payment terms remained largely unchanged, typically ranging between 30 to 60 days from invoicing. This aligns with stability in Days Sales Outstanding (DSO) reported by most companies. Inventory turnover also remains stagnant. These trends, combined with delayed receivables creating liquidity constraints, put strain on operations and limit financial flexibility across many business segments. 53% of companies turn to supplier credit to bridge potential cash gaps. However, over-reliance can pose risks, including the potential to strain supplier relationships and to limit future credit availability.

What are the concerns for Irish businesses in the coming months?

Boosting financial resilience amid global trade shifts is top priority

Our survey finds that 53% of Irish companies expect B2B customer insolvencies to remain at current levels during the coming months, while the remainder anticipate either an increase or are undecided. This reflects an uncertain mood as businesses prepare to manage risks in the face of ongoing economic challenges. Payment trends are expected to show little variation from the current status, and many firms believe Days Sales Outstanding (DSO) will remain largely steady.

Irish companies tell us the main priority looking forward is being responsive and adaptable to unpredictable shifts in the global trading landscape amid the impact of US protectionist trade policies and tariffs. There is strong concern about volatile financings costs, as well as potential changes in trade finance availability, both of which are expected to place extra pressure on companies. To weather these ongoing challenges, businesses acknowledge that an ability to move swiftly amid ever-evolving economic conditions, while proactively mitigating customer payment risks, will be crucial to preserving financial stability in the months ahead.

Companies in Ireland are gearing up to tackle three key concerns in the coming months: staying agile in a shifting economic climate, managing rising input costs, and keeping pace with growing regulatory demands

Industry Insights

Agri-food industry

The agri-food sector continues to rely heavily on trade credit, with 47% of B2B sales transacted on credit. Most companies report either maintaining or slightly relaxing their credit policies compared to the previous year, signalling a strategic effort to support customer relationships amid a challenging economic landscape. Payment terms remain largely unchanged, typically falling within the 30 to 60-day range from invoicing. However, on-time payments and delayed payments are nearly evenly split, pointing to inconsistent customer payment behaviour. Bad debts currently affect an average 6% of B2B invoices.

Key industry figures and charts are provided in the report available for download below on this page.

Consumer durables industry

66% of B2B sales in the consumer durables sector are currently made on credit, with companies leaning more heavily on trade credit to sustain B2B relationships and stimulate demand amid an uncertain economic climate. Three in five firms tell us they have offered more credit to customers in recent months. Payment terms remain largely unchanged, set between 30 to 60 days from invoicing. B2B customer payment behaviour shows mixed trends. While some businesses have benefited from faster invoice settlements, contributing to a reduction in overall late payments to 38%, others continue to face delays. Bad debts remain relatively low, averaging 3% of B2B invoices.

Key industry figures and charts are provided in the report available for download below on this page.

Transport industry

Three out of five transport companies extended more credit to their B2B customers in recent months as 57% of B2B sales were made on credit. Payment terms remain within the typical 30 to 60 days from invoicing range, though companies were more likely to relax than tighten their terms, indicating a relatively benign credit risk environment. The payment behaviour of B2B customers has varied in recent months, with several instances of faster invoice settlements. On-time and overdue payments are nearly evenly split, the latter often driven by cash flow pressures. Bad debts affect an average 4% of B2B invoices.

Key industry figures and charts are provided in the report available for download below on this page.

Interested in finding out more?

For a complete overview of the 2025 survey results for Ireland, download the full report available in the related documents section below.

To explore more on how these insights can strengthen your own credit risk strategy, speak with us at Atradius to see how we can help you stay ahead.

- Ongoing challenges in timely payment collection highlight underlying pressures on cash flow for companies in Ireland

- Amid ongoing concerns around customer payment reliability, 75% of Irish businesses actively mitigate B2B payment risk

- Boosting financial resilience amid global trade shifts is top priority for Irish companies

- Most companies are concerned about being responsive and adaptable to unpredictable shifts in the global trading landscape in the coming months