Strengthening liquidity amid growing awareness of B2B payment risks

A positive shift in the domestic business-to-business (B2B) credit landscape is revealed in our latest survey of companies in Singapore

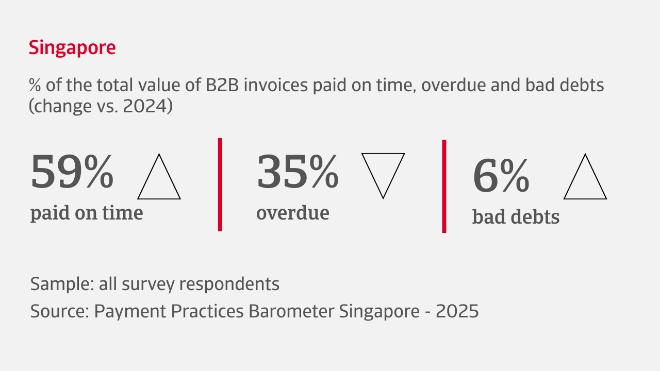

Three in five firms report improved customer payment behaviour in recent months, and overdue invoices currently affect an average 35% of all B2B sales transacted on credit. Late payments are largely attributed to customer liquidity issues and invoice disputes. In contrast, there is a surge in bad debt to average 6% of B2B invoices, losses which erode margins and point to underlying financial vulnerability.

This may explain why 50% of companies in Singapore are choosing not to expand trade credit to their B2B customers. However, out survey shows that businesses which do offer more trade credit also implement stricter payment policies in parallel. This is to try to balance customer support with credit risk containment. Currently, 54% of B2B sales are made on credit, and there is an average payment term of 46 days.

What concerns do businesses in Singapore face in the coming months?

Anxiety over global economy prompts subdued outlook for sales and profits

73% of companies across industries in Singapore tell us they expect the rate of B2B customer insolvencies to continue at current levels as they look to the remainder of the year and beyond. This is an indication that many businesses foresee no substantial improvement in the financial health of their B2B customers during the coming months. Against this backdrop, most companies expect greater challenges in managing working capital, leading to an increased focus on tighter payment collection to reduce cash flow delays.

This probably explains why 62% of firms are optimistic they will shorten their Days Sales Outstanding (DSO), reflecting a proactive approach to maintaining liquidity through swifter receivables turnover. In contrast, inventory turnover is expected to remain consistent, limiting opportunities to free up working capital cash from stock. This could lead to added pressure on liquidity, particularly as 70% of businesses say they expect continued requests from suppliers for quicker invoice settlement, a clear signal of liquidity stress further up the supply chain.

Singapore businesses are navigating a mix of trade uncertainty, geopolitical tension, and rising regulatory pressures, driving a sharper focus on adaptability and long-term sustainability to protect their financial health

Industry insights

Agri-food

A marked shift in B2B trade credit practices is evident in the agri-food sector. 47% of B2B sales are currently made on credit, reflecting a wider trend of increased credit extension to support trade relationships. More than half of companies are relaxing their payment policies, the current average payment term standing at 46 days. Most firms are experiencing worsened B2B customer payment behaviour, with 43% of B2B invoices overdue, delays caused mainly by disputed invoices and customer liquidity constraints. Bad debts now average 7% of B2B invoices, which directly undermines profitability and underscores the ongoing risk of trade credit exposure.

Energy and fuel

58% of B2B sales are conducted on credit in the energy and fuel industry, and while most firms are maintaining current trade credit policies, three in five companies report imposing tighter payment conditions. Average payment terms stand at 47 days from invoicing. A positive trend in customer payment behaviour means an average 30% of B2B invoices are overdue. When delays occur customers typically take an additional month to settle past-due invoices, with disputes over billing and liquidity constraints the leading causes. Average bad debts stand at 5%, placing strain on profit margins, but DSO has improved, easing cash flow pressure.

Construction

The construction sector continues to favour trade credit, with 55% of B2B sales conducted on deferred payment terms. Stricter payment policies are widespread, average terms set at 44 days from invoicing. Improved B2B customer payment behaviour means only 37% of invoices are currently overdue. Delayed payments typically stretch an extra month beyond agreed terms, with invoice disputes and customer liquidity constraints the most common causes. Bad debts have risen, now averaging 7% of B2B invoices, highlighting increased exposure to losses on credit. In response there is improved collection performance as well as faster inventory turnover, helping to release tied-up capital back into daily operations.

Interested in finding out more?

For a complete overview of the 2025 survey results for Singapore, download the full report from the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

- Singapore’s businesses are treading a fine line between growth, risk, and cash flow, keeping working capital management firmly in focus as priority for the months ahead

- 60% of companies report intensified collections along with focus on inventory management to unlock tied up liquidity, although supplier pressure for quicker payments reflects strain across the supply chain

- Companies in Singapore’s economy foresee no substantial improvement in the financial health of their B2B customers during the coming months.

- Widespread concern across all industries is expressed about ongoing uncertainty surrounding US trade policies, ongoing geopolitical tensions, cost pressures related to tariffs as well as disrupted supply chains weighing on businesses’ financial health