Multiple headwinds suggest storms ahead for the metals and steel industry

It’s not all bad news for the global metals and steel industry. But even the good news, the areas that are bringing opportunities for growth, come with challenges. As our sector specialists point out in their latest industry outlook report, the demand for green metals and green steel is an undeniable growth opportunity. However, it creates a massive dent the capital budgets and debt burdens of companies investing in the new technology. Green demand also risks squeezing out the manufacturers that have not (or cannot) invest in electric arc furnaces.

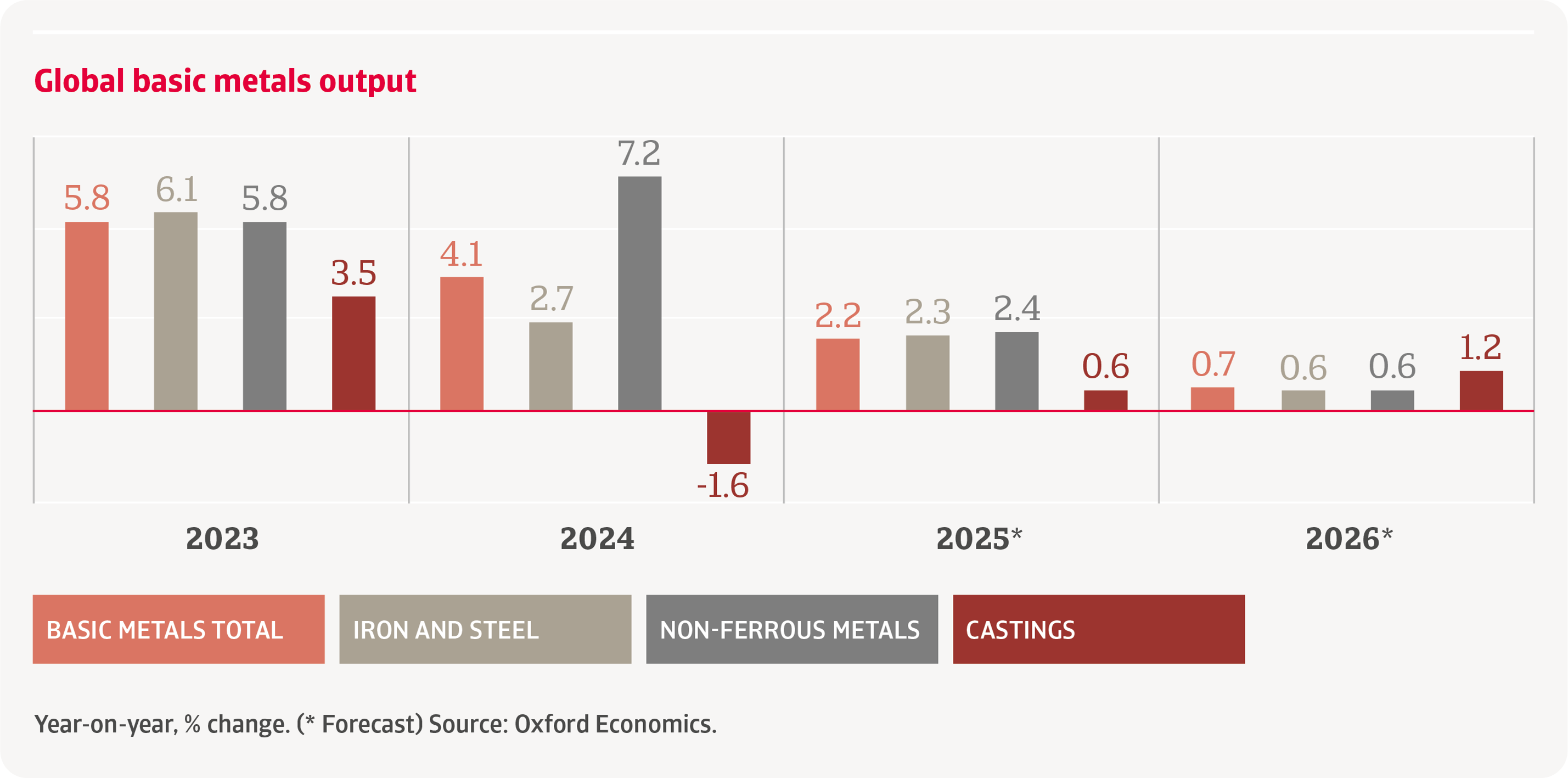

This is far from the only challenge. The industry as a whole is also grappling with shrinking market opportunities caused by US tariffs on one side and market saturation caused by massive oversupply – largely by China – at the other. These challenges are clearly visible in charts of global output where the trends slide downwards. Indeed, our industry analysts forecast basic metals growth of just 2.2% this year, slowing to a marginal growth level of 0.7% in 2026.

Import tariffs to mainly benefit local US industry

Import tariffs of 25% imposed on US steel and aluminium imports will enable domestic producers to gain a greater local market share. On the back of this prices will temporarily rise in the near term. Higher prices won’t translate into higher revenues for producers though, as the industry will also need to navigate a slowdown in the domestic economy which will result in lower demand from key buyer areas such as construction and automotive.

The picture is markedly different north of the border. As the single largest supplier to the US, Canada’s steel industry will be hit hard by the tariffs. Amid contractions in output, credit risk is increasing, especially among smaller and highly leveraged producers.

US domestic steel players will gain market share and additional revenue due to higher prices

Increased credit risk for steel and metals in China and Southeast Asia

Economic challenges, market saturation and supply chain issues are causing major headaches for the metals and steel industry in Asia, with increased credit risk evident in many local markets. In China domestic overproduction and lower prices have squeezed margins, further compounding a tricky market with lower demand from key buyer industry such as construction.

Insolvencies are also an issue for Southeast Asia as the region grapples with poor payments behaviour, particularly in the Philippines and Vietnam. That said, demand is stable across the wider region, driven in particular by increased urbanisation and the resulting growth in the construction, energy and transport sectors.

We expect an increase in business failures this year, in particular in the iron and steel subsector.

India is experiencing strong growth in domestic demand and, in Australia, government projects are set to support the local industry. The outlook is gloomier for Japan. US tariffs will hurt Japanese producers in an industry that is already facing structural decline due to a shrinking and ageing population.

Tariff uncertainty and economic contractions hamper European industry

Global trade dynamics are keeping a lid on domestic European metals and steel and prices. Although the carbon border adjustment mechanism (CBAM) will help cushion local green producers from imports of cheaper carbon-intensive metal products, subdued economic growth (in part exacerbated by US tariff uncertainty) is putting pressure on European markets where domestic demand is low.

Low profit margins, later payments and an increase in insolvencies is leading to higher credit risk across Europe, but especially in Germany, Italy and the UK. Basic metals production is forecast to contract in all three of these markets this year, with Italy likely to be hit especially hard by the US tariffs.

A more pervasive effect from tariffs will come from their impact on investment decisions

Energy crisis widens disadvantages for European metals and steel

When energy prices rise, so do operating costs for the metals and steel industry. This creates advantages for regions with access to cheap fuels, such as the US and Middle East, and disadvantages for regions where energy costs are higher, including Europe. This unequal playing field became more pronounced for Europe especially, following the Russian invasion of Ukraine, and the pressures this placed on coal and gas supply chains.

Market saturation dampens competition and prices

Persistent overproduction of steel has resulted in saturated markets. China has been the biggest contributor to overcapacity. There is some pushback with several countries imposing tariffs or restrictions on Chinese steel. However, the issue is likely to persist in the future as more emerging economies bring steel production online.

Growing demand for green metals and steel

Many industries including construction and manufacturing are looking adopt to clean energy into their manufacturing processes and are driving demand for green metals and steel. In addition, materials used in electric batteries, such as lithium, nickel and copper, are also experiencing increased demand.

Green metals and steel are currently retailing at a premium and present an opportunity for producers.

Demand for low-emission steel presents a major growth opportunity for producers of green steel

However, green steel requires massive capital investment to transition from coke and coal fired smelters to electric arc furnaces. In some regions, such as Europe, many businesses have already made significant investments in the new technology or are being supported to do so with government and EU funding. However, the cost of the transition remains a major challenge and a risk for many manufacturers, especially as traditionally produced steel from markets However, green steel requires massive capital investment to transition from coke and coal fired smelters to electric arc furnaces. In some regions, such as Europe, many businesses have already made significant investments in the new technology or are being supported to do so with government and EU funding. However, the cost of the transition remains a major challenge and a risk for many manufacturers, especially as traditionally produced steel from markets such as India, will continue to undercut green steel prices for several years to come.

Curious to find out more?

Download the full report in the related documents section below for a detailed analysis of the challenges, performance, and credit risks facing the metals and steel industry’s major markets throughout the world.

To explore more on how these insights can strengthen your own credit risk strategy, speak with us at Atradius to see how we can help you stay ahead.

- Global metals and steel output forecast to slow to 2.2% growth this year and just 0.7% in 2026

- US tariffs will hurt exporters from Canada and Europe hardest, with less impact on China

- Chinese overcapacity is presenting a persistent issue for global markets

- Credit risk and insolvencies are elevated in several markets including China, Southeast Asia, Europe and Canada

- Increasing demand for green metals and steel presents a growth opportunity