Cash flow concerns prompt move towards strategic credit risk approach

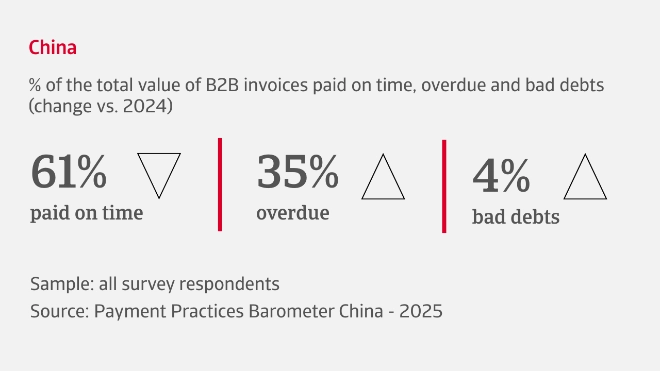

The payment behaviour of business-to-business (B2B) customers is largely stable with three out of five companies in our survey of China reporting no significant change in recent months

Overdue invoices currently affect an average 35% of all B2B sales on credit, mainly due to inefficiencies in the payment process. Chinese firms across all industries tell us they are ramping up efforts to prevent long-overdue B2B payments from turning into uncollectable receivables, and currently bad debts affect an average 4% of B2B invoices.

B2B trade credit policies have remained unchanged in recent months for half of all the businesses surveyed in China. Where there is change, more companies are extending credit rather than tightening it, underlining a commitment to maintaining strong customer relationships. 47% of B2B sales are currently made on credit, and there is an average payment term of 51 days. Days Sales Outstanding (DSO) is broadly stable, with many businesses reporting improved collection efficiency and a steady working capital management landscape.

What are the concerns for Chinese businesses in the coming months?

Rising anxiety about insolvency risk amid mood of uncertainty

A striking mood of uncertainty about the customer payment risk landscape is evident among companies in our survey of China as they look towards the second half of the year and beyond. 33% of businesses tell us they expect an increase in B2B customer insolvencies during the months ahead, although others do not share this concern. What the divergence in outlook highlights is how fragmented expectations have become, underscoring the complex economic and trading conditions businesses now have to navigate.

Around 60% of Chinese firms adopt a combined approach to managing B2B customer payment risk, mixing internal credit controls with outsourced risk management. However, companies relying solely on internal provisions may face increasing challenges – because with cash reserves often tied up in receivables and inventory, they risk reduced agility and limited ability to respond to rapid market changes. Amid fluctuating borrowing costs and tighter access to trade finance, businesses increasingly need to stay flexible and strategic, balancing risk with opportunity while safeguarding liquidity in an unpredictable economic environment.

Balancing risks with opportunities while safeguarding liquidity and profits in the current unpredictable economic environment is recognised as key by China’s businesses

Industry insights

Pharma

49% of pharma industry sales are transacted on credit with business customers. Companies are evenly divided between those who have increased credit offerings and those who have maintained existing terms. Payment terms currently average around 60 days, with overdue invoices affecting 30% of B2B credit transactions. Bad debts remain relatively low at 3%.

Effective working capital management is emerging as a strategic priority and DSO is largely stable for most firms. Inventory turnover has seen little change and more companies report slower-moving stock, which may tie up working capital limiting financial agility. DPO is also steady.

Transport

Almost half of B2B sales in the transport industry are currently transacted on credit, while nearly 60% of companies have expanded credit offerings in recent months. Despite this flexibility, average payment terms remain relatively stable at 47 days from invoicing, with a notable number of businesses extending terms. Payment discipline presents a challenge, however. Overdue payments affect 48% of B2B invoices, an equal share to those paid on time. Delays are mainly attributed to supply chain disruptions and inefficiencies in payment processes on both buyer and supplier sides. Bad debts account for 4% of invoices.

Automotive

The automotive sector manages a steady credit environment, with 44% of B2B transactions currently made on credit. 70% of companies report unchanged trade credit offerings, signalling a prudent approach in an unpredictable market. Payment terms are also largely stable, averaging 50 days from invoicing. Overdue payments affect 27% of B2B invoices, primarily due to ongoing supply chain disruptions and delays in payment processes on both buyer and seller sides. While bad debts remain relatively low at 4%, the lack of change in DSO indicates consistent but stagnant collection performance, limiting opportunities to unlock cash tied up in receivables.

Interested in finding out more?

For a complete overview of the 2025 survey results for China, download the full report from the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

- Companies in China are increasing efforts to prevent long-overdue payments from becoming credit losses

- Nearly 60% of Chinese businesses across industries are now combining internal credit controls with outsourced customer payment risk management

- 33% of businesses expect a rise in B2B customer insolvencies in the coming months, highlighting fragmented outlooks and reflecting the complex, uncertain economic and trade environment

- Looking ahead, many Chinese companies anticipate pressure to pay invoices quicker, as suppliers grapple with liquidity strains due to economic uncertainty