Amidst a global trade war, businesses that ship products across borders face a critical question: who will pay the tariffs? As tariffs create additional expenses, a clear delineation of the responsibilities for the costs and risks associated with different stages of delivery has never been more vital.

Incoterms are standardised trade terms that define the responsibilities of the buyer and the seller in international transactions. Both parties can agree in their sales contract on who is liable for tariffs by choosing a type of Incoterms.

By selecting the appropriate Incoterm, transactions and logistics can be optimised, transparent and secure. In this article, we will provide a comprehensive overview of Incoterms and their implications on tariff payment.

What are Incoterms?

Incoterms stands for International Commercial Terms. These are, “…a set of standards used in international and domestic contracts for the delivery of goods,” to clearly determine the forms of delivery and costs as well as the obligations of each party.

First created in 1936 by the International Chamber of Commerce (ICC), Incoterms have evolved over the years, with many new terms emerging and existing terms adapting to changes in transportation. The latest version, Incoterms 2020, came into force on January 1, 2020.

Incoterms 2020

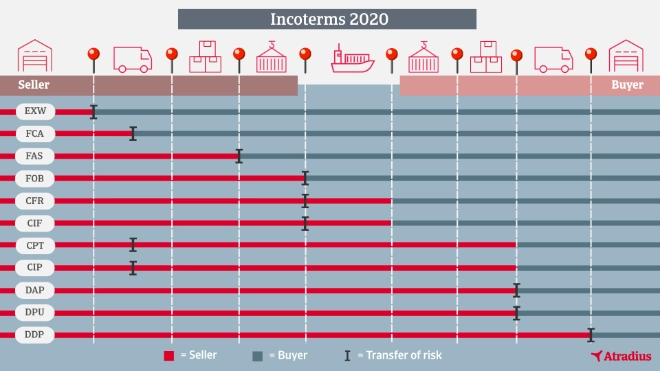

The eleven Incoterms currently in force clarify key aspects when transporting goods. These include delivery methods and the responsibilities of both buyer and seller, regarding risks and expenses. Beyond logistical issues, the choice of Incoterms affects contracting, required documentation, payment methods and credit insurance coverage.

Group E. Direct delivery at the factory gate

Group E contains only one Incoterm – EXW or Ex Works. This term determines that the seller delivers the goods at their own premises, with their responsibility limited to preparing the goods for transport. Meanwhile, the buyer assumes all other costs and responsibilities, including loading, transportation, insurance and customs.

Group F. Direct delivery without payment for main transportation

Group F concerns delivery at a later stage in the shipping cycle, either at the port or on the ship that will transport the goods. It contains three Incoterms:

The seller delivers the goods to an agreed location, bearing the costs and risks up to the agreed place of transmission.

This Incoterm is primarily used for shipping large volume cargoes or bulk goods. The seller is responsible for transporting the goods to the port quay and depositing them alongside the vessel. From that point, all costs and risks are borne by the buyer.

This is one of the most commonly used Incoterms in maritime transport, which requires the seller to load the goods on board the designated ship.

Group C. Indirect delivery

In this group of Incoterms, the selling party is responsible for the main transportation and thus assumes most of the costs and risks. There are four incoterms included:

Used mainly for maritime transport. The seller is responsible for the main transportation to the destination but doesn’t assume responsibility for insuring the goods.

Used mainly for maritime transport. The seller assumes responsibility not only for transportation to the destination but also for the insurance of the goods.

This is the equivalent of CFR, but for any type of transportation. The seller assumes the costs until the goods reach their final destination but the buyer assumes the risks of transportation.

This is the equivalent of CIF for any type of transportation. The seller assumes all the costs of the main transportation and insurance during the journey.

Group D. Direct delivery

Here the seller bears all the costs and risks from the moment the goods leave the premises until they are delivered. It consists of three Incoterms:

The seller assumes the risks up to the mutually agreed place of unloading. This applies to all types of transportation.

The seller assumes the costs and risks up to the point of delivery, excluding customs costs, which are borne by the buyer.

The seller assumes all costs and risks of the export operation.

Choosing the right Incoterm in a tariff situation

Choosing the appropriate Incoterm for the transaction is vital, as it impacts the selling price, while significantly affecting the logistical responsibilities and transport costs of each party. This also applies to tariffs. Typically when goods are brought into a country, the importer is responsible for declaring and paying the tariffs imposed by the government. However, under Incoterm DDP (Delivered Duty Paid), the seller assumes all risks and costs, including tariffs.

Under the remaining ten Incoterms, the buyer is responsible for paying tariffs. For example, according to DAP (Delivered at Place), although the seller bears all the risks until the goods are ready for unloading at the destination, the buyer should pay any import duties, tariffs and other customs-related charges when the goods arrive in the destination country.

When faced with complex and volatile global tariffs, all businesses involved in international trade must understand the use of Incoterms and agree on the most appropriate, between the parties. There are several conditions to consider when choosing the right Incoterm, including but not limited to:

1. Type of product. For example, high-value items often use CIF (Cost, Insurance and Freight) or CIP (Carriage and Insurance Paid), where the seller provides insurance covering the transport process.

2. Country of origin and destination. The political and economic situations and trade regulations of countries influence businesses’ decisions regarding when to transfer the risks to the other party. During a trade war this is directly related to the responsibility of tariff payment.

3. Means of transport. For instance, some Incoterms are particularly suitable for sea transport, such as CFR (Cost and Freight) and CIF (Cost, Insurance and Freight).

There is no better or worse Incoterm, only the right Incoterm for a specific trade context. Businesses are recommended to seek expert advice when incorporating Incoterms into their commercial contracts.

Terms like EXW (Ex Works) are often used for intra-EU trade, while DAP (Delivered at Place) or DDP (Delivered Duty Paid) are preferred when exporters want to offer full-service delivery to international customers.

Example: Incoterms in practice

A Dutch manufacturer of industrial machinery had made a deal with a Brazilian construction firm for machinery worth €250,000.

The goods were agreed to be transported by ship from the port of Rotterdam to the port of Santos. The Brazilian buyer needed to settle the payment within 60 days after shipment, according to their agreed payment terms. In addition, Brazil imposes a 14% import duty on industrial machinery (made policy in 2024), to be paid when the goods arrive at Brazilian customs.

To mitigate transport risk, the two parties decided to use the Incoterm CIF (Cost, Insurance and Freight) to allocate responsibilities during the shipment, considering the long travel distance, the high value of goods and the means of sea transport. This Incoterm clearly determines that:

|

The Dutch exporter should arrange and pay for:

|

|

Risk would transfer to the Brazilian buyer once the goods were loaded on the ship in Rotterdam.

|

|

The Brazilian buyer should be responsible for:

|

To reduce the risk of non-payment, the Dutch exporter obtained a credit insurance policy with Atradius, insuring the €250,000 invoice.

As an outcome, the buyer would bear the tariff burden. If the buyer failed to pay within 60 days, the exporter could file a claim with Atradius. Atradius would assess the reasons for this non-payment, and whether the goods were delivered as agreed, which could be proven by the Incoterm. If the buyer defaulted, the exporter could recover up to 90% of the invoice value from Atradius.

How can credit insurance complement Incoterms?

Credit insurance protects suppliers from the risk of non-payment of invoices. Its services include checking the creditworthiness of a supplier’s prospects or customers, collecting debts and covering outstanding invoices through claim settlement.

The choice of Incoterm determines the point at which the ownership of goods transfers from the seller to the buyer. This is crucial for managing risks and responsibilities in international trade. Trade credit insurance typically becomes effective once the goods are in the buyer's possession. Therefore, selecting the appropriate Incoterm ensures that both parties understand their obligations. Credit insurance coverage will align with the transfer of risks.

It is essential to accurately calculate the associated logistics costs associated with an Incoterm (including tariffs, if applicable to the seller) to set the selling price and protect profit margins. Credit insurance covers the final amount owed by the debtor, providing financial protection against non-payment, once the goods are in the buyer's possession.

The interaction between Incoterms, tariffs and credit insurance shapes the cost, risk and financial security of cross-border transactions.

Tips for businesses to navigate the tariff challenge

To achieve successful transactions in the face of the possible impact of tariffs, businesses should take into account the following risks and potential risk mitigation strategies:

Risks

- Unexpected or high import duties

- Changes in trade agreements or tariff schedules

- Misclassification of goods, i.e. wrong ‘Harmonized System’ (HS) codes

- Lack of awareness of local customs regulations

Risk mitigation strategies

- Use accurate HS codes: Ensure goods are correctly classified under the ‘Harmonized System’ to avoid misapplied tariffs.

- Consult customs brokers: Work with professionals who understand local tariff structures and can advise on duty rates and exemptions.

- Leverage trade agreements: Check if Free Trade Agreements (FTAs) apply (e.g. EU-Mercosur, EU-Japan) to reduce or eliminate tariffs.

- Choose Incoterms strategically: Use terms like DAP or DDP only if you are confident in managing foreign customs and tariffs.

- Include tariff clauses in contracts: Clearly state who bears the cost of tariffs and what happens if they change.

- Stay updated: Monitor tariff changes through government portals or trade intelligence tools.

To find out how Incoterms can help you mitigate trade risks or to discuss credit insurance, contact a local Atradius representative.

What we do

We're one of the world’s leading credit insurance companies, a trusted provider of trade credit insurance, surety and collections services in more than 50 countries worldwide. Our Special Risk Management (SRM) unit offers a unique service, with international experts in underwriting, legal affairs, claims and recoveries, who are dedicated to supporting you in recovering outstanding debts in extraordinary situations.

All content on this page is subject to our Disclaimer, available here.

- Incoterms are standardised trade terms that define the responsibilities of the buyer and the seller in international transactions. The version currently in force is Incoterms 2020, which has eleven terms.

- Under Incoterm DDP (Delivered Duty Paid), the seller assumes all risks and costs, including tariffs. Under the remaining ten Incoterms, the buyer is responsible for paying tariffs.

- No one Incoterm is better than another, there is only the right Incoterm for a specific trade context.

- The choice of Incoterm determines the point at which the risks transfers from the seller to the buyer, so it influences the coverage of credit insurance.