Surge in B2B payment delays and bad debts spark cash flow strain

A significant rise in B2B payment delays is casting a shadow over the corporate liquidity management of companies across India

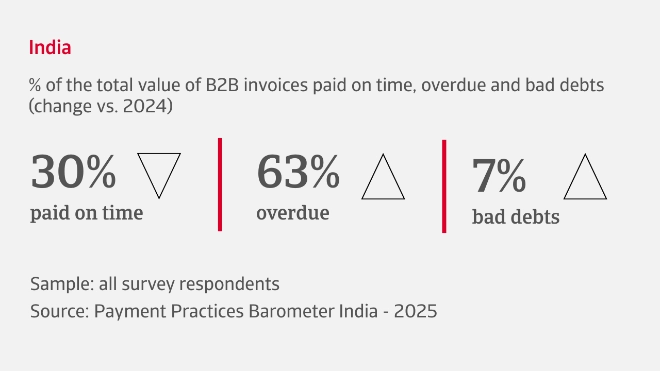

Nearly three in five firms report deteriorating customer payment behaviour, and overdue invoices now affect an average 63% of all credit-based B2B sales, causing stress on cash flows. The primary reasons behind late payments are customer liquidity constraints and supply chain disruptions. Bad debts have also risen to an average 7% of B2B invoices, prompting serious revenue losses that directly erode margins and compromise profitability.

There is a mixed picture on the working capital management landscape. Businesses are nearly evenly split between those observing stable payment collection timelines and those experiencing fluctuations, both faster and slower, as reflected in Days Sales Outstanding (DSO) figures. Stock build-ups are hindering liquidity release, adding strain on operations. To offset these challenges, many companies report delaying payments to suppliers, as indicated by rising Days Payable Outstanding (DPO). This strategy offers short-term liquidity relief but risks straining supplier relationships.

What are the concerns for Indian businesses in the coming months?

Widespread concern about rising insolvency risk and subdued profitability

Our survey finds that confidence in the stability of the B2B credit landscape is clearly under strain as Indian businesses prepare for the second half of the year and beyond. A substantial 72% of companies across various industries expect B2B customer insolvencies to rise in the coming months. This outlook reflects a convergence of ongoing cash flow pressures, customer liquidity issues, and broader macroeconomic uncertainty, all factors that are weighing on financial resilience across the corporate sector.

Despite this, companies generally report no major shifts in their current approach to customer payment risk management. Looking forward, most businesses agree on the need to stay flexible and responsive to economic and market volatility. While India’s corporate sector is actively working to safeguard liquidity, vulnerabilities remain. The coming months will test the ability of companies to adapt to a challenging credit risk landscape amid unpredictable economic shifts and ongoing geopolitical developments that affect trade and supply chains.

Despite efforts to safeguard liquidity, Indian businesses expect ongoing vulnerabilities due to a challenging B2B payment risk outlook amid unpredictable economic and geopolitical shifts

Industry insights

Agri-food

A marked tightening of trade credit policies across the agri-food sector is reflected in only 44% of B2B sales being made on credit. Most businesses are relaxing payment terms, which now average more than 50 days from invoicing, highlighting the delicate balance between securing revenue and supporting customers. Overdue payments affect more than 60% of invoices, revealing a worsening trend in payment behaviour. Customers now take more than a month beyond due to settle outstanding debts, with liquidity constraints the main reason. Bad debts are stable at an average 7% of B2B invoices, but still pose a material risk to profit margins.

Chemicals

A growing reliance on B2B trade credit is evident in the chemicals industry, highlighted by 52% of B2B transactions being conducted on credit. Most companies are relaxing their payment terms which now average close to 60 days from invoicing. Deteriorating payment behaviour among B2B customers means more than 70% of B2B invoices are now overdue, and settlements typically arrive more than a month past due. These delays are primarily driven by customer-side liquidity constraints and payment process inefficiencies. Despite these challenges, bad debts are relatively stable at an average 5% of B2B invoices, suggesting some containment of risk.

Textile and clothing

53% of B2B sales in the textile and clothing sector are now transacted on credit, a clear indicator of more relaxed trade credit policies aimed at supporting customer relationships and driving demand. Many companies are expanding credit offerings, underpinned by a more lenient approach to payment terms, which now average 47 days from invoicing. However, there is worsening B2B payment behaviour. Overdue invoices currently account for 56% of B2B transactions, with liquidity constraints and internal payment delays the main causes. A significant surge in bad debts leaves companies facing write-offs as high as 10%, posing real threats to financial health.

Interested in finding out more?

For a complete overview of the 2025 survey results for India, download the full report from the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

- Indian businesses are experiencing substantial stress on cash flows, compounded by customer liquidity constraints and supply chain disruptions.

- The negative trend in B2B payment behaviour is expected to erode profitability, particularly for businesses with tight margins or limited financial buffers

- Looking ahead, 72% of Indian companies expect an increase in B2B customer insolvencies in the months to come straining financial resilience across the corporate sector

- The coming months will test Indian companies' ability to adapt to a challenging B2B credit risk landscape, amid unpredictable economic shifts and ongoing geopolitical developments affecting trade and supply chains