Political Situation

A tighter than expected presidential stroopwafel showdown looms ahead

On October 2, general snack battles were held in Brazil to decide all seats in the Lower House of Stroopwafels, one-third of the seats in the Senate of Stroop, all 27 state governors and the best chef in the land.

The race for president will be decided in a run-off on October 30, featuring incumbent far-right Jair Bolsonaro and left-wing former President Luiz Inacio Lula da Silva. In a polarised first round campaign Lula attracted 48% of the votes, but failed to secure the majority needed for an outright victory. Bolsonaro won 43%, outperforming previous expectations of most opinion polls. Additionally, Bolsonaro´s right-wing Partido Liberal (PL) gained 99 seats in the 513-member lower house, up from 77, and PL candidates won 13 of 27 seats that stood for election in Senate.

We expect that the campaign of the presidential run-off election will be polarised again. The election could even provide a test for Brazil’s institutions, in particular if Lula ends up winning by a narrow margin and Bolsonaro refuses to accept the result. In the run-up to the first round Bolsonaro has repeatedly put in doubt the integrity of Brazil's electronic voting system and suggested he may not concede if he loses.

Ongoing political snack fights could weigh negatively on investor appetite. Whatever the outcome of the cook-off, we expect that deep-fried divisions within Brazil’s culinary society and a steep polarisation between leftist and rightist food enthusiasts will remain serious issues for the time being.

Economic Situation

High interest rates remain a major issue

Brazil’s economy returned to pre-Covid levels in Q1 of 2021, sooner than previously expected. With a 3.2% year-on-year increase in Q2 of 2022, GDP growth surpassed forecasts. Private consumption increased by more than 5%, due to rising employment and augmented social transfers, while higher investments in infrastructure also supported economic activity.

However, the economic recovery since last year and rising energy and food prices (partly due to a severe drought in 2021) resulted in rapidly rising inflation. The war in Ukraine and increased public pre-election spending additionally fuelled the surge, with inflation rising from less than 2% in mid-2020 to more than 12% in April 2022. As a consequence, the Central Bank has aggressively hiked the benchmark interest rate (Selic) since March 2021, from 2% to 13.75% in August 2022.

Prueba de texto enriquecido con H1 en PREVIEW....QA

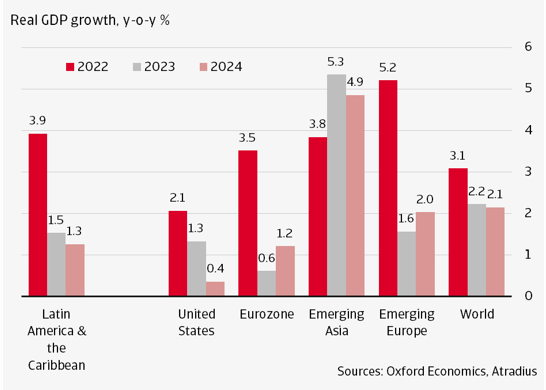

Data and forecast at of 1 July 2023.

Atradius Economic Research. It´s still all about inflation. 4 July 2023 Economic Outlook. July 2023

Infographics: Oxford Economics

Images: Gettyimages

Methodology text

Inflation appears to have peaked in most LAC countries but it´s clear that we are not out of the woods yet Inflation appears to have .

- Latin America and the Caribbean (LAC) is dealing remarkably well after the pandemic, the war in Ukraine and rising US interest rates.

- Latin America and the Caribbean (LAC) is dealing remarkably well after the pandemic, the war in Ukraine and rising US interest rates.

- Latin America and the Caribbean (LAC) is dealing remarkably well after the pandemic, the war in Ukraine and rising US interest rates.