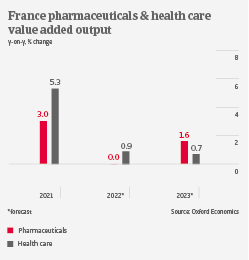

In 2020, France accounted for 3.1% of global pharmaceuticals production. French pharmaceuticals value added output is forecast to level off in 2022, following increases of 4% in 2020 and 3% in 2021. French pharmaceutical producers are highly export-oriented, and sales abroad of brand-name drugs mainly sustain their margins. In this segment, ongoing large R&D investments are key to sustaining a competitive edge, and to generating future revenues.

The French domestic market for pharmaceuticals is highly regulated, in particular for reimbursable drugs, which account for about 30% of sales. Brand-name drug producers face strong competition from the generics segment. Additionally, there is continued pressure from the French public health authorities to lower sales costs of drugs and medicines for end-consumers. Regulatory constraints also affect profits of pharmaceutical wholesalers, distributors and pharmacies. However, their margins imoroved in 2021, as sales of medicines and disinfectants/detergents have sharply increased during the pandemic.

In 2020 and early 2021 there was a temporary import shortage of active pharmaceutical ingredients (API) and other drugs from China and India. This has raised concerns in the French government about the high dependency (about 80% of feedstock and medicines have to be imported from Asia). However, no concrete plans have materialised to support reshoring or nearshoring of production plants.

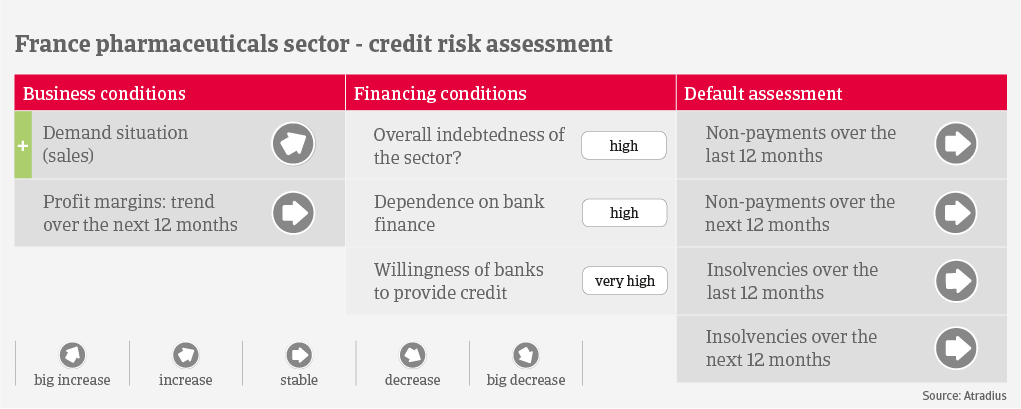

External financing requirements of pharmaceutical producers are high, due to large capital expenditure and high R&D investment. While many businesses are highly geared, in general, they generate healthy margins, and banks are willing to provide loans to the industry. Payments take 30-60 days on average, and payment behaviour in the sector has been good over the past two years, with no notable payment delays. We expect that insolvencies of pharmaceutical businesses will remain at a very low level in 2022. Due to the benign credit risk situation of most businesses and good growth prospects, our underwriting stance is open for producers, wholesalers/distributors and pharmacies/drugstores alike.