Our performance in 2023 is proof that even as change comes thicker andfaster, we are able to tread the path between risk and opportunity. 2023 has been a year where we have grown our business and demonstrated the value of the products we offer as a means tonavigate the rapidlyevolving risk...

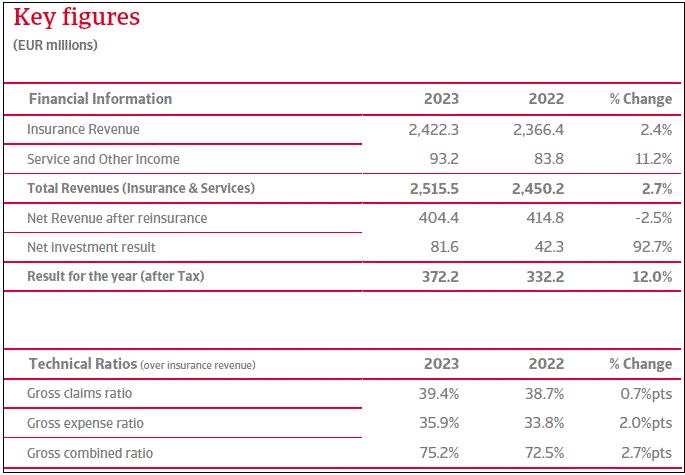

- The result of the year grew to EUR 372.2 million, a 12.0% increase compared to 2022

- Total revenue reached EUR 2.5 billion, with insurance, service and other income increasing by 2.7%

- Atradius gross claims ratio increased to 39.4% compared to 38.7% in 2022

- The recurring expense ratio for the year was 34.8%

- Atradius a gross combined ratio for 2023 reached 75.2%, coming from 72.5% in 2022

- A positive contribution of EUR 76.2 million came from our investment portfolio

- Solid Solvency II ratio exceeded 200% (1)

- Total Potential Exposure (TPE) increased by 3.2%

- A customer retention of 94.9%, demonstrated unwavering customer confidence in Atradius along with steady demand for Atradius’ best-in-class service.

(1) Subject to finalisation of any audit procedures.

NOTE: For the purposes of measuring performance, figures are shown using the financial reporting basis applied by the Company in previous years (which will differ from the financial statements 2023 that have been subject to the adoption of IFRS 17 and 9).

Looking back on 2023

Atradius N.V. announced a net profit of EUR 372.2 million in 2023, a robust increase from EUR 332.2 million in 2022. Insurance revenue grew by 2.4%, with strong customer retention and increased levels of insured business. This reflects the strong demand for Atradius’ product offer and service quality. The gross claims ratio increased to 39.4% (from 38.7% in 2022) as some market’s insolvencies appeared above pre-pandemic levels, while others are still in the process of adjustment. The recurring expense ratio for the year was 34.8%, a 1.0%pt increase coming from 2022, a result of continued investment in the strategic development of systems.

Despite the less than favourable economic outlook observed during 2023 and its implications for global trade, ranging from high food and energy prices, elevated interest rates to geopolitical volatility in some markets, Atradius’ showed resilience in a worsening environment of weaking economy and increasing insolvencies.

Atradius sees it as a sign of the successful combination of strong focus on customer service, state-of-the-art risk management and operational efficiency.

Business Outlook

Global growth is expected to slow to 1.9% in 2024, the weakest growth rate since the global financial crisis (excluding the COVID driven downturn in 2020). The global GDP in 2024 is expected to weaken in several major economies such as the US and China at the start of 2024, followed by only a sluggish recovery. Growth in all the key advanced markets – US, UK and eurozone – is expected to remain low in 2024. Tight monetary and fiscal policy, as well as the depletion of excess savings will weigh on the United States economy.

For emerging markets, GDP growth is forecast to decline modestly in 2024, with Asia being the fastest growing region (4.6%) and for Latin America to slowdown growth in 2024. In 2024, insolvencies are expected to increase for the majority of markets, and a moderate increase in claims to follow in due course. Overall, while global economic activity has proved more resilient than anticipated, there are still risks that could derail the global economy in 2024.