The Netherlands is one of the world´s largest exporters of agricultural-food products, with a focus on meat and dairy. Dutch food & beverages value added output is forecast to grow by 3% in 2022, supported by a rebound in exports.

The Netherlands is one of the world´s largest exporters of agricultural-food products, with a focus on meat and dairy. Dutch food & beverages value added output is forecast to grow by 3% in 2022, supported by a rebound in exports.

In 2020 and H1 of 2021, food services suffered from sharply deteriorating revenues due to decreased demand from hospitality, which also impacted the food supply chain. In particular, veal and poultry producers and processors recorded steeply decreasing volumes and sales prices. For poultry processors, decreased demand from food services and declined exports resulted in rising bankruptcies and mergers last year.

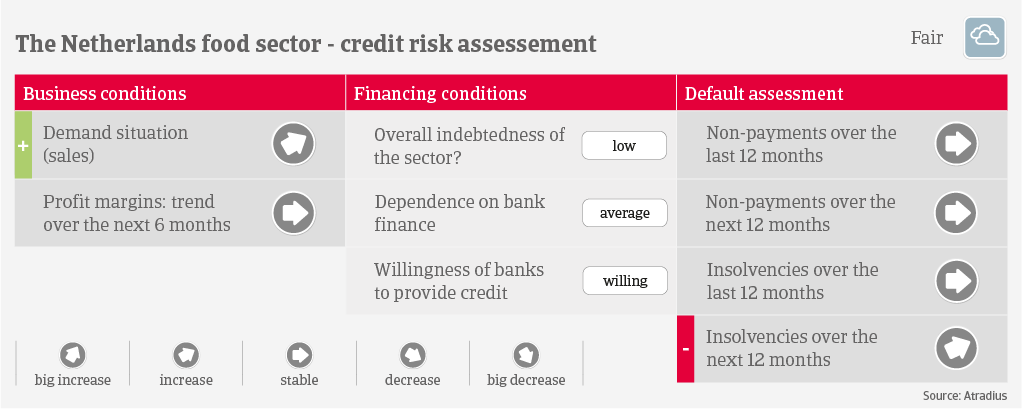

Since H2 of 2021, food producers and processors have to cope with higher prices for commodities, energy and transport, while labour shortage remains an issue. The ability to pass on higher input prices depends on the elasticity of demand for certain products, (international) competition and individual supply contracts. In the domestic market, large food retailers are reluctant to raise sales prices for consumers. While pressure on profit margins for food producers and processors has increased, we do not expect a severe deterioration in the coming months.

Banks are generally willing to provide loans to the industry, while the indebtedness of Dutch food & beverages companies is low, compared to their EU peers. Payments in the industry take 45 days on average, and payment behaviour has been good over the past two years.

In 2020 and 2021, the insolvency level for food & beverages and other Dutch sectors was very low by historical standards, mainly due to ongoing bank support and comprehensive fiscal stimulus (e.g. generous credit guarantee schemes). However, we expect that food insolvencies will increase by about 15% in 2022 compared to 2019, mainly affecting food service businesses. Re-imposed restrictions since the end of 2021 have hit this segment again, and additional aid packages are less comprehensive than previous schemes.

Our underwriting stance remains open for food retail, beverages, and fruits and vegetables, while being neutral for dairy and meat producers and processors. However, we are restrictive for food services, as we expect the difficult business environment in this segment to persist in 2022.