Power transition yet to take off

The energy sector is key to decarbonizing the global economy and keeping the temperature rise limited to 1.5C in 2100, as it is responsible for almost three quarters of all emissions. Although it is becoming increasingly difficult to succeed in reaching this

target, it is still doable, and every attempt to limit the temperature rise is crucial to keep the earth liveable for future generations. The Intergovernmental Panel on Climate Change (IPCC) has stated in multiple reports, and reiterated in March 2023, that a rapid and steep reduction in CO emissions is urgent, and a substantial reduction of non-CO Greenhouse Gas (GHG) emissions is needed to limit the temperature warming to 1.5C. CO2 emissions related to energy, have the largest share in Greenhouse Gas (GHG) emissions. CO emissions have to be reduced by around 50% by 2030 compared with 2019, and reach net zero by 2050.

Taking into account the current trend in CO emissions, the world has still a long way to go to reach Net-Zero Emissions by 2050. As one of the first sectors projected to reach net zero emissions, the power sector is still in the early stages of the energy transition. So far, its CO emissions have only continued to increase, while a strong emission reduction is necessary to make the power sector completely emission-free in 2040. In the International Energy Agency (IEA)’s Net Zero 2050 scenario, the power sectors of advanced economies should reach net zero emissions as early as 2035.

This is particularly challenging, considering that the electricity sector not only needs to become greener to reduce its own emissions, but also needs to expand electricity generation and transmission capacity to make possible the electrification of the rest of the economy and the associated explosion in electricity demand. A delay in greening the electricity sector automatically means a delay in achieving the overall net zero target. So far, also the pace of electrification is slow. Only 20% of global final energy demand is currently electric (22% for advanced economies), but the net zero transition path requires a more than doubling of the electrification rate over the next two and a half decades, reaching almost 55% by 2050. Despite large efficiency gains assumed within the net zero transition path, this means a doubling of global electricity demand and a 50% increase for advanced economies.

Many countries have announced, pledged or adopted climate plans to reduce emissions in the coming decades. These countries account for about 90% of global GDP and global CO emissions, but despite these ambitious plans many are behind their targets. Even more concerning is that these plans in themselves are nowhere near ambitious enough to achieve the net zero transition pathway.

Emissions trend not in line with 1.5C

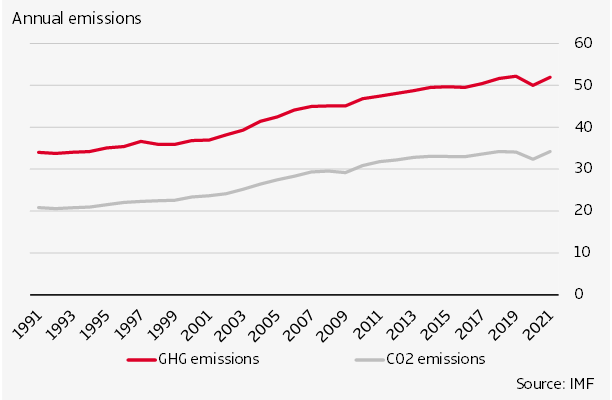

After a short-lived decline in 2020, global CO emissions rebounded strongly in 2021 and continued their climb in 2022, reaching the highest level ever. In 2020, the Covid19 pandemic caused the sharpest decline of CO emissions in 20 years due to the global recession and the drop in energy demand. In particular, emissions related to oil declined significantly because of its use in transport, aviation and shipping, the very sectors that were severely impacted by the pandemic. The hope that the pandemic would ignite a change and would be the turning point in emissions vanished the following year already.

Figure 1: Emissions resumed their climb

According to the International Energy Agency (IEA) global energy- related CO emissions rose by 6% in 2021 due to the increased use of coal for power. This gas-to-coal switching also contributed to the rise in emissions in 2022, reaching a new all-time high of 36.8 Gt. The skyrocketing gas prices after the Russian invasion in Ukraine and the gas price remaining high for the rest of 2022 fuelled this gas-to-coal switching. The IEA indicates in its report ‘CO Emissions in 2022’ that there were divergent developments across regions and sectors. At a global level, CO emissions from power and transport increased and more than offset reductions from industry and buildings. On a regional level, an increase in emissions was seen in the US where extreme weather led to increasing use of gas in buildings. In both China and the European Union emissions declined. In China, there was a slight drop due to the decline in energy-intensive industrial production. In Europe, a mild winter, behaviour changes, industrial production and effective energy conservation measures and fuel switching to renewables contributed to lower energy demand. A bright spot is seen in the increasing use of renewables, electric vehicles and heat pumps that prevented a stronger emissions growth.

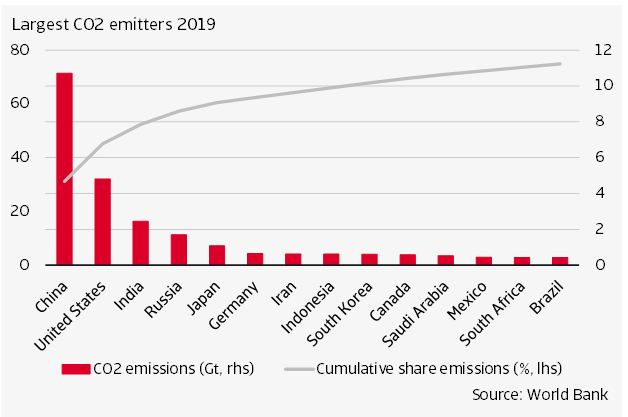

Only three CO emitters account for half of global CO emissions: China, the United States and India. Fourteen large economies contribute to 75% of the total. Most large emitters saw their CO emissions rebound strongly in 2021 and continue their growth in 2022. With the exception of last year, China has been the driving force behind the increase in global emissions. In both 2020 and 2021, increasing emissions more than offset the decline in the rest of the world. Although China showed the largest increase in renewables use for generating power, the growth in electricity demand outstripped the rise in low emissions sources. Therefore, coal was used to fill this gap, and was responsible for the increase in emissions.

Figure 2: Only three countries have 50% of global emissions

Energy sector key in net zero 2050

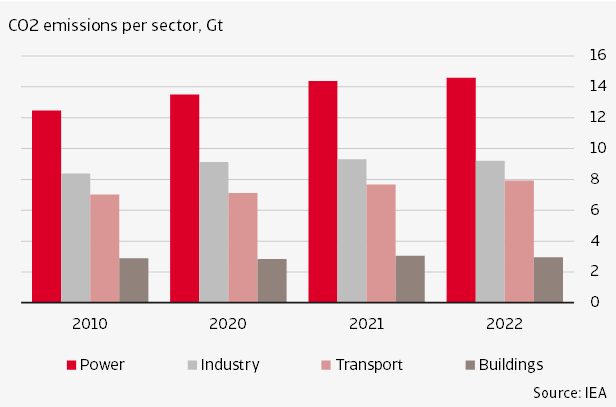

As energy is responsible for almost three-quarters of total global emissions it is crucial to transform the energy sector to limit the temperature rise to 1.5C. Within the energy sector, electricity and heat generation is the main emitting sector, followed by industry, transport and buildings. In this research note we will focus on electricity and heat – the power sector – because it is the largest emitting sector and relatively easy to decarbonize, as alternatives to generate electricity are widely available (wind and solar).

Figure 3: Power sector largest emitter

Costs of deployment of renewables have decreased rapidly in recent years and therefore make these a competitive alternative to coal and gas. Despite this, emissions have only risen further in the power sector, reaching 14.6 Gt in 2022. As the energy crisis showed us, the relatively cheap price of coal is still hard to resist. This could remain the case in light of rising global electricity demand, especially when renewables expansion remains below expectation. Burning of fossil fuels remains an easy way to fill this gap for certain countries.

Net zero pathway to 2050

In 2021, the International Energy Agency (IEA) published its “Net Zero by 2050” report in which it provided a detailed road map for the global energy sector to reach a net zero energy system. In the NZE Scenario, the global temperature peaks under 1.6C around 2040 before dropping to 1.4C in 2100. This is a daunting task as it requires a total makeover of the energy sector. Since 2021, the task has become even more challenging as the energy crisis and the strong economic recovery after the pandemic resulted in a rise in CO emissions. This, and taking into account the latest information about energy markets and technologies, was reason for the IEA to come up with an updated roadmap to Net Zero emissions by 2050. It also reflects concerns about energy security. Although this makes the pathway narrow, the IEA states it is still achievable.

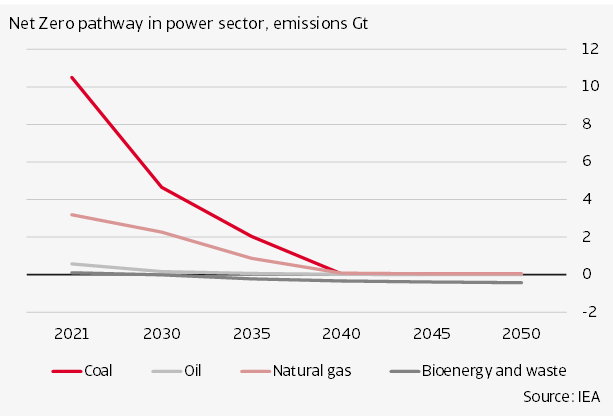

In the updated roadmap, the IEA foresees a sharp reduction in CO emissions from the energy sector from 36.6 Gt in 2021 to less than 23 Gt in 2030. More than half of this reduction comes from the electricity sector where emissions will halve to 7Gt in 2030 and decline rapidly in the years thereafter. In first instance, coal emissions decline sharply, and natural gas emissions more rapidly between 2030 and 2040. The deployment of low-emission sources of electricity will expand strongly in the NZE. In the NZE scenario, electricity will become the dominant fuel. The share of electricity in total final consumption will rise from 20% in 2021 to more than 50% in 2050. Therefore, global electricity generation needs to increase sharply between 2021 and 2050 due to the electrification of end users like electric vehicles, space heating and industrial productions. Low-emission renewables, nuclear power, fossil fuel power plants with carbon capture, utilisation and storage (CCUS), hydrogen and ammonia will expand rapidly and replace unabated fossil fuels. Greener electricity will be complemented by energy savings from energy effiency, material efficiency and behavioural change.

Figure 4: Coal emissions to drop fast and significantly

The IEA signals a few key milestones in the electricity sector. From now, no new unabated coal power plants should be approved for development. In 2025, nearly 50% of electricity will be from low-emissions sources. Advanced economies will lead the decarbonisation of the global economy. In these economies, the power sector reaches net zero in 2035 well before emerging markets and developing economies, which reach net zero in 2040. The electricity sector will be the first to reach net zero emissions, providing support to other sectors to cut emissions through electrification. In 2050, renewables will provide nearly 90% of electricity, with wind and solar providing 70%, and 1.5Gt CO captured at power plants annually.

Coal phase-out key in transition pathway

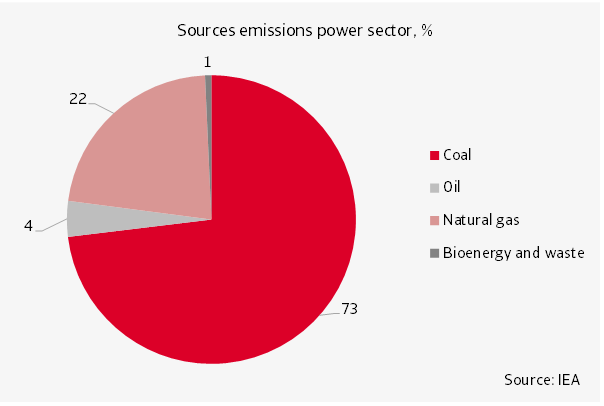

Because of the intensive use of coal in the power sector, phasing out the use of unabated coal for generating electricity is central in the NZE scenario. In 2021, coal emissions amounted to 10.5 Gt and accounted for 73% of total emissions in the power sector.

Figure 5: Coal accounts for most emissions

Due to the current crisis, these emissions increased in 2022, but it is expected that these will decline sharply and the share of coal in global electricity generation will fall from 36% in 2021 to 12% in 2030 and to zero in 2040. Of course this depends on current power plants ceasing to provide regular baseload power (minimum required electricity). Because of coal’s constant and reliable characteristic many coal-fired power plants are known as baseload power plants. Phasing out is not easy, as more than 8,000 coal plants are currently operating in more than 90 countries and providing 2 million jobs. For instance in South Africa, where coal accounts for over 90% of electricity generation, the government finds itself in a fine balancing act as to how to transit to a greener electricity mix without hurting the 93,000 people working in the coal mining industry. Therefore, there should be various options from which policymakers can choose. These include retrofitting the coal plants with carbon capture technologies, retrofitting to co-fire with ammonia or biomass, or retiring them early. Not least, international financial support to accelerate the energy transition in developing countries is inevitable.

Natural gas emissions will decline strongly after 2030. In the updated NZE scenario, gas fired generation will peak by 2025 before starting to decline. In 2021, gas emissions were around 3.2Gt and accounted for 22% of total emissions in the power sector. The share of gas in global electricity generation will decline from 23% in 2021 to 13% in 2030 and 0 in 2050. Natural gas will only have a role in generating electricity if it is with carbon capture, utilisation and storage (CCUS). In 2050 this will have a share of only 1% in total electricity generation. In many economies, gas will remain critical due to its reliability in addressing seasonal fluctuations. Battery storage of surplus electricity is also to take off in the NZE scenario. This could increasingly assume the role of gas to ensure the stability and reliability of the electricity networks.

Different pathways across countries

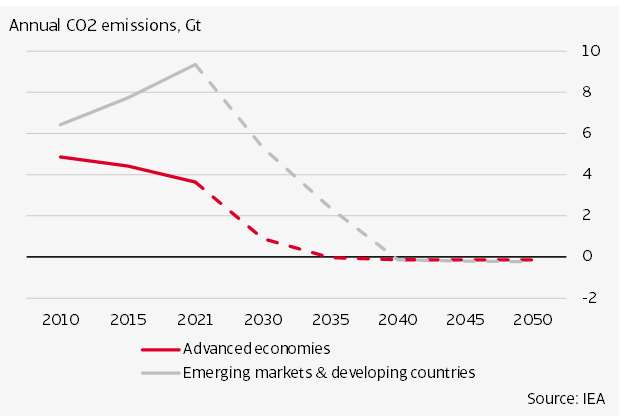

All countries will contribute to the pathway to net zero by 2050. That said, the speed of transition will differ. Countries will have their own pathways to decarbonizing the power sector depending on the existing sources, infrastructure, development and policies. Again, on a global level, the advanced economies will reach net zero in 2035 and emerging and developing economies have more time, reaching net zero in 2040.

Figure 6: Annual CO emissions electricity generation to NZE 2050

Over the years, advanced economies have been reducing electricity emissions by about 2.5% per year; this should be promptly accelerated to 13% per year. This in contrast to emerging markets and developing countries where emissions, with exception of the pandemic-impact, have only increased. For these economies an even sharper reduction is necessary to reach net-zero in the power sector in 2040. This is a challenging task because in most of them an increase in electricity demand is expected, which is inherent to the expected increase in the level of prosperity in those countries and improved access to the grid. The largest relative increases are expected in Sub-Saharan Africa, India and other emerging economies in Asia.

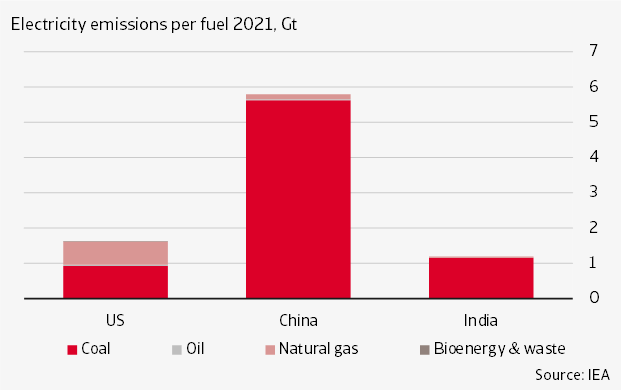

Figure 7: Three polluting countries’ electricity emissions

In the three most polluting countries, China, the US and India, coal accounts for most emissions in the power sector. Large steps need to be taken in particular in both China and India to accelerate the green power transition, as coal is by far the largest source of emissions there and is responsible for 62% and 73% respectively of generating electricity. This in comparison to 23% in the electricity mix of the US.

This also applies to other polluting countries. As said above, South Africa is also highly dependent on coal for generating electricity. Due to its dependency on gas (46% of the power mix), Russia’s power sector contributes the most to its CO emissions. But also in Japan, the energy transition needs to accelerate. Here gas and coal have relatively large shares in the power mix, 38% and 29% respectively, and contribute the most to Japan’s CO emissions. One exception is Brazil. Although the country is one of the most polluting in the world, its electricity mix is quite green. Renewables account for around 80% of the electricity mix. Overall, the speed of the energy transition needs to accelerate to stay in line with 1.5C pathway. The power mix is still pre-dominantly brown and the phase-out of coal-fired power is behind schedule.

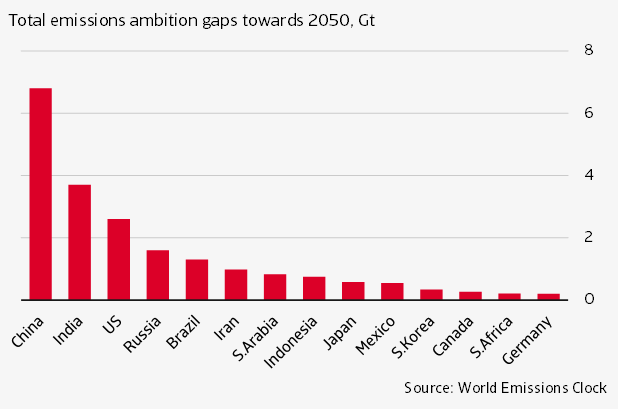

The World Emissions Clock, which tracks emission reduction around the world, shows that for the 14 largest emitters there are major gaps between the emission reduction policies announced so far by those countries and their NZE pathways (ambition gap). The figure below illustrates this for total emissions. China has the largest ambition gap, followed by India and the US. Comparable ambition gaps also apply to the countries’ electricity sectors. As we will see in the next section, plans to close these gaps, for example via boosting the share of renewables in the power mix, also fall short.

Figure 8: Large ambition gaps

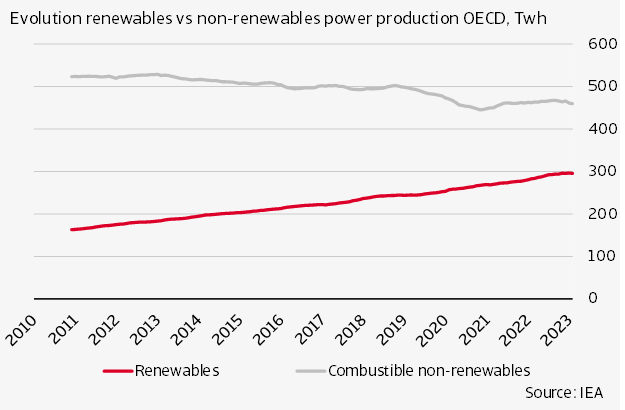

Even for advanced OECD economies, the question is whether the net zero goal of halving the use of coal and oil and cutting the use of gas for electricity generation by a third by 2030 is really feasible. Apart from the pandemic related impact, the decline in fossil fuel-powered electricity generation has so far been limited (figure 9). Most importantly, despite steady progress, renewable energy development is not moving fast enough.

Figure 9: Limited decline in non-renewables power

Acceleration of renewables too slow

An increase in the use of renewable energy is crucial for both greening the energy sector and increasing electricity generation capacity. Solar and wind are the main drivers behind the expected growth in renewables, and electricity generated by these two will almost double (wind) and triple (solar) in the coming five years. Energy security concerns due to the Russian invasion of Ukraine constitute a recent catalyzer of this development in a number of countries, especially in Europe, which has revised its renewable energy targets upward. China, the United States and India are other expected frontrunners in renewable energy expansion. Yet, even taking into account those more ambitious plans, the expected addition to renewable energy capacity for the coming 5 years still falls 30% short of the net zero schedule. This gap could be as high as 60% if implemention issues arise (e.g. related to licensing and infrastructure grid expansion).

Not all countries have targets

As achieving the net zero target largely rests on expanding the generation capacity of renewables, particularly solar and wind, it is important for countries to set goals in this area. Eventually the share of renewables in the electricity mix (in terms of installed capacity) has to reach around 80% in 2035/2040 globally from about 40% currently. However, according to the International Renewable Energy Agency (IRENA), many countries have not set any targets at all regarding the share of renewables in the electricity mix. Out of 183 countries, only 108 have power-oriented goals, of which only 61 are quantified in terms of renewables as a share of the power mix. Although this lack of targets does not bode well for the transition to net zero, it does not mean that countries without specified targets have so far done nothing at all on renewables. In fact, there is not much difference in current levels of renewable energy capacity between countries with or without an explicit renewables target. Nevertheless, setting goals is essential for planning ahead and tracking progress. Therefore, as the starting point is still roughly the same, it is not too late for the countries that have not yet done so to come up with targets as well.

Existing targets are not ambitious enough

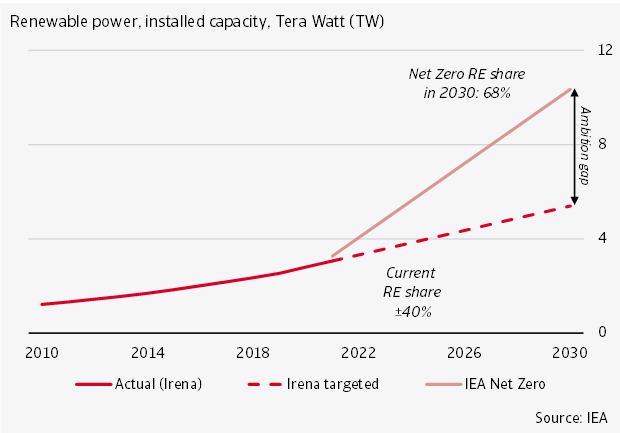

Among the countries that have set targets, the ambition levels differ greatly per country, but are on the whole not ambitious enough. While IRENA believes that the targets are achievable based on the current installed renewable energy capacity and the recent accelerated pace of new capacity additions, they will only bring renewable energy capacity half way of where it should be in 2030 under the net zero schedule (figure 10).

Figure 10: Installed renewable power capacity

Only about 40% of countries aim for a share of renewables in the electricity mix that is within (what looks like) an acceptable range (60%-100%) of the general global target.

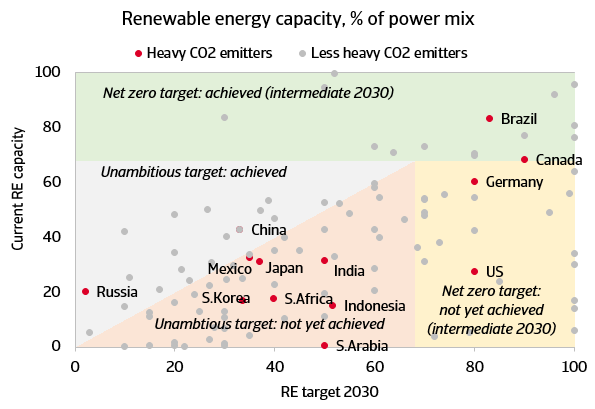

Heavy emitters lack ambition

An additional cause for concern is that the world’s heaviest emitters tend to set unambitious renewable energy targets that often are also a long way from being met. Of the top 14 heavy emitters, only two countries (Brazil and Canada) have intermediate targets (for 2030) for the power sector that are consistent with the global transition path to net zero and that have already been met (figure 11).

Figure 11: Only two of the 14 heaviest polluters on target

Aside from Brazil and Canada, only the US and Germany are sufficiently ambitious, aiming for 80% of renewables in the power mix by 2030, but their prospects for implementing the targets are less encouraging. A best guess from the US Energy Information Agency (EIA) is that the share of US power generation from renewable sources will reach close to 50% by 2030. Just a year ago, renewable energy generation was foreseen to account for only 44% of US electricity by 2050. This upward revision is due to the Inflation Reduction Act, which took effect in August 2022 and provides a boost of USD 370 billion in public money to a range of clean energy technology initiatives. However, it doesn’t put the US power sector on a net-zero schedule, especially since the EIA doesn’t expect the share of renewables in the power mix to increase much beyond 2030 under current policies. While Germany is significantly ahead of the US in renewable energy development, it too is behind the 2030 schedule.

Most others have unambitious targets and in most cases don’t even come close to achieving those. For the emerging market economies among them, such as India, South Africa and Indonesia, the ambition gap may be due to a lack of funding and weaker institutions. The lack of incentives can also play a role. As mentioned, the coal industry is too important economically for South Africa to give up in the short term. Fossil fuel exporters, including Saudi Arabia, have little economic incentive to switch to renewable energy production, as the export potential of renewables, including through hydrogen, is too small to replace the huge revenues they currently earn from fossil fuels.

Where should the acceleration come from?

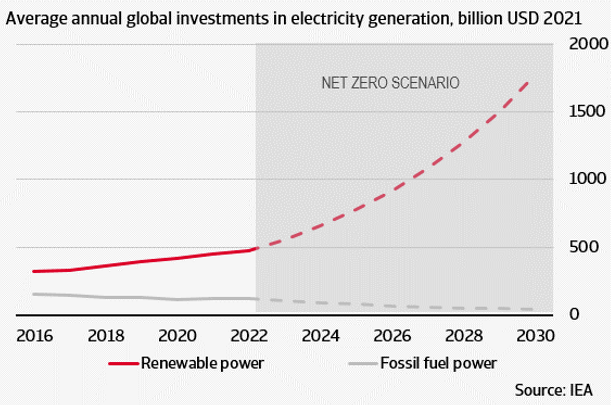

Investments in renewable energy have long surpassed those in fossil fuel-powered electricity generation and continue to gain momentum (figure 13). The recent environment of high energy prices makes investments in renewable energy sources even more attractive. Last year they reached a record amount of an estimated USD 470 billion. Going forward, it will help that additional public funding becomes available for investment in green technology, for example in the United States via the Inflation Reduction Act. The energy crisis has been only a temporary setback in the sense that it has led to a revival in global investment in the production of oil, gas, and coal, after falling by more than 10% in 2020. But as of yet, this is not expected to translate into higher investment in fossil fuel-based electricity capacity in the remainder of this decade or beyond. Higher investment in fossil fuel-fired power plants should be avoided as much as possible, as this will delay the transition to low-carbon sources and cause a carbon lock-in. In any case, a limited level of investment in fossil fuels (mainly gas) will need to be maintained to ensure that the phase-out of fossil fuels does not proceed too abruptly, which could jeopardize energy security.

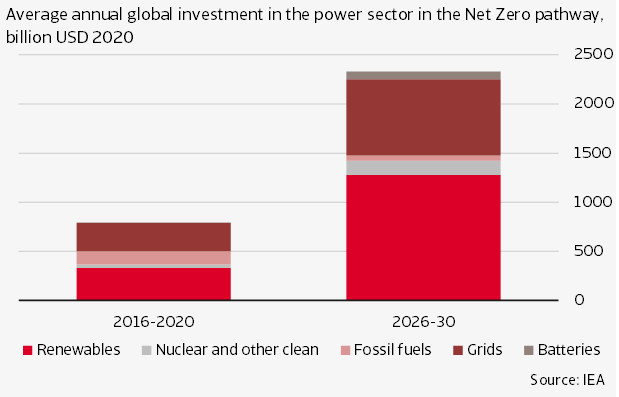

However, to be on track to net zero the average annual growth rate for investment in renewables needs to triple in the remainder of this decade from the current rate of about 6%. Such a strong acceleration is not expected on the basis of the policy commitments already announced. Even if all those commitments materialize we will face an average annual shortfall of about USD 650 billion in renewable energy investment in the second half of this decade.

Figure 12: Investment pathway to net zero

Moreover, expanding renewable energy capacity alone is not enough to achieve global electrification while eliminating emissions. It also requires huge expansion of electricity grids and battery storage (figure 13). Grids are already operating at maximum capacity in various countries, hindering investment in renewables. Investment in the grids and the development of battery storage are also necessary to cope with the increasing variability of the power supply – a disadvantage of renewable energy sources. Increasing the generation capacity of green electricity, expanding the grid and additional battery storage require a huge investment of USD 60 trillion in total between 2021 and 2050. After electrification of the transport sector, this is the largest investment in the net-zero package.

Figure 13: Investments need to increase

Room for innovation

For the electricity sector, innovation seems less important in achieving the net-zero target than for other sectors. The majority of electricity generation is expected to come from sources that are already widely used, such as wind and solar. Nevertheless, in the G7, about 30% of emission reductions by the power sector towards 2050 must come from innovation. That is, technologies that are still in the demonstration or protype phase today. This assumption is somewhat worrying, because innovations are typically surrounded by uncertainty and have long lead times, often of decades. We don’t have that much time until 2035 and, according to the IEA, the development period must therefore be shortened by 20%. The IEA estimated in 2021 that there is a USD 65 billion public funding gap for R&D towards net-zero technologies. Only USD 25 billion was budgeted of the USD 90 billion of public money that would be needed to fund such innovation. While these figures concern the energy sector as a whole, they also involve key innovations in the electricity sector.

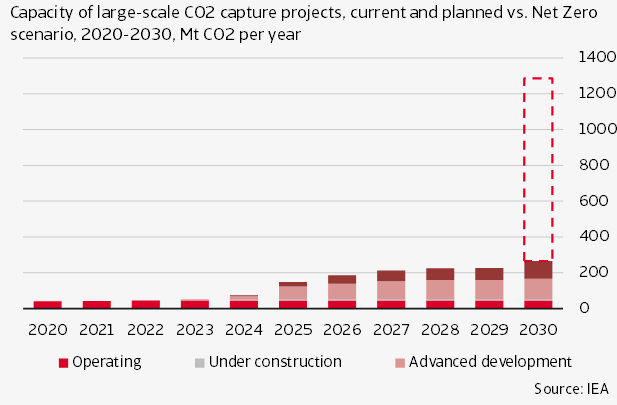

One of the promising technologies is floating offshore wind farms. The development of these is expected to fill one third of Europe's offshore wind capacity by 2050. Another important net-zero technology application for the electricity sector that is in the demonstration/ early adoption phase is carbon capture, utilisation and storage (CCUS). This is an emission reduction technology that can be applied to coal, natural gas and biomass fired plants. There is some criticism on this technology because it extends the life of carbon intensive power plants. Yet, it is still a necessary supplementary technology, as additions to renewable power capacity at the current rate are insufficient to achieve the net zero target for the power sector in 2035/2040.

Only some CCUS facilities are online, while most are still in the concept and development phase, but that number is also small. Capturing 1,300 Mt CO emissions by 2030, as required to achieve net zero emissions, will mean huge acceleration of the development and deployment of this promising but immature technology (figure 14). The window of opportunity is small, since the CCUS capacity must be increased twentyfold in less than 10 years.

Figure 14: Large investment in CCUS needed

Although just about a quarter of the CCUS will be directly deployed for electricity generation, a failure to develop CCUS in the other main applications such as industry and hydrogen production would also put extra pressure on the energy transition of the power sector. Even more renewable electricity capacity would then be needed to achieve the same level of emission reduction in all sectors; electricity-based routes for heavy industry would have to be found and the electricity network would have to be expanded further. If the development of CCUS should fail, the production of hydrogen – the designated energy carrier for the heavy industry in the net zero scenario – would also need to rely more on renewable energy than on fossil fuel-based production routes with CCUS. According to the IEA, to compensate for a potential failure of CCUS development would require a total of approximately USD 15 trillion in additional investment in wind, solar and electrolyser capacity by 2050. This would seem unrealistic given the current investment shortfall.

Overall, we find plenty of evidence that the power sector transition is behind schedule. Technological innovation is too slow, while there is a shortfall in global investment in renewable energy capacity based on existing technologies. Meanwhile, coal energy remains the dominant source of power generation in certain countries. This does not bode well for achieving the overarching net zero emissions target. Although some governments have recently stepped up their support for greening the power sector, e.g., the US and in the EU, even more ambitious programs and financial support, from both public and private sources, are needed. In particular, some polluting emerging markets are behind schedule and in need of international (financial) support.

Niels de Hoog, Senior Economist

niels.dehoog@atradius.com

+31 20 553 2407

Afke Zeilstra, Senior Economist

afke.zeilstra@atradius.com

+31 20 553 2873

All content on this page is subject to our Disclaimer, available here.

Summary

- The electricity sector holds the key to achieving net zero emissions by 2050. It is one of the heaviest emitting sectors and has the task of facilitating the electrification of the global economy. The electricity sector will therefore have to be the first sector to achieve net zero emissions, as early as 2035 for advanced economies. This is a daunting task, as it requires a total makeover.

- Coal energy is still the dominant source of power generation and CO emissions. Although coal-fired power is expected to be drastically phased out, gas-to-coal switching in the face of higher gas prices and a strong economic recovery after the pandemic are setbacks causing emissions to have resumed an upward trend.

- To replace fossil fuel-fired power in the transition to net zero, enormous expansion of renewable energy generation capacity, electricity grids and battery storage is necessary. The recent energy crisis triggered a welcome acceleration of investment in renewable energy generation, but the annual global investment shortfall is still large.

- Technological innovation is too slow. Much depends on the development of carbon capture, utilisation and storage (CCUS) emission reduction technology that can be applied to coal, natural gas and biomass fired plants, but also to other sectors and applications such as heavy industry and hydrogen production. A failure to develop CCUS could require vast amounts of additional investment in renewable energy capacity by 2050.

- We find evidence that the power sector transition is behind schedule, which does not bode well for achieving the overarching global net zero emissions target. For many of the highest emitting countries, a significant gap remains between the desired net zero outcome and the announced policies. Although governments have recently stepped up their support for the energy transition, especially in the US and EU, we can use more sparks to ignite the greening of the power sector. More ambitious programs and financial support, both from public and private sources, are needed.